This is an excerpt from an article I originally published on Seeking Alpha on November 15, 2011. Click here to read the entire piece.)

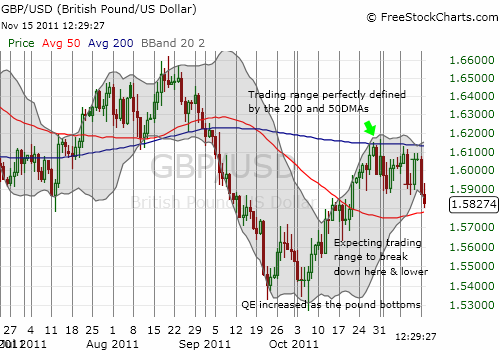

Ever since the Bank of England announced more quantitative easing in the form of £75B of more bond buying, the British pound has bottomed and rallied against the U.S. dollar and Japanese yen. Global stock markets also bottomed and rallied around this time, so, perhaps the pound was carried upward with the strong tide. Over the past three weeks, the pound has stalled out against the U.S. dollar. A massive currency intervention gave the pound further lift against the yen, but that tide has now come to an end. All signs point to a resumption in fundamental weakness for the pound.

Source: FreeStockCharts.com

This week is full of important economic announcements from the U.K. I will be most intrigued by the Inflation Report. Inflation has exceeded the Bank of England’s (BoE) target of 2% for two years now …{snip}…I strongly expect the BoE to roll out at least one more round of QE in the near future. Contrast this prospect to the stiff political resistance faced by the Federal Reserve for further quantitative easing.

{snip}

Be careful out there!

This is an excerpt from an article I originally published on Seeking Alpha on November 15, 2011. Click here to read the entire piece.)

Full disclosure: net short the British pound