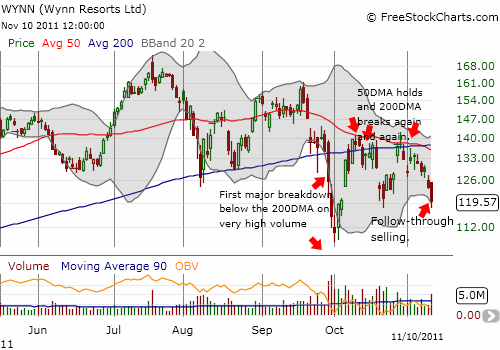

Wynn Resorts, Limited (WYNN) almost seems like a car wreck moving in slow motion. I have followed the multiple breakdowns unfolding in WYNN over the past two months. Today’s 3.5% loss represents follow-through selling from another failed attempt to break through dual resistance at the 50 and 200-day moving averages (DMAs). The October low still needs to give way for WYNN’s breakdown to receive final confirmation.

This weekly chart reminds us of WYNN’s strength over the last three years.

The unfolding technical pattern means the trading bias for WYNN is a short.

WYNN has been surprisingly strong coming off the recovery from the recession, especially now with economic slowdown and recession on the lips of so many. The current breakdown is the worst bout of relative weakness that the stock has experienced in this period where the uptrend clearly dominated. While casinos may be stumbling, luxury retail is still hanging tough (tonight’s earnings for Nordstrom not withstanding).

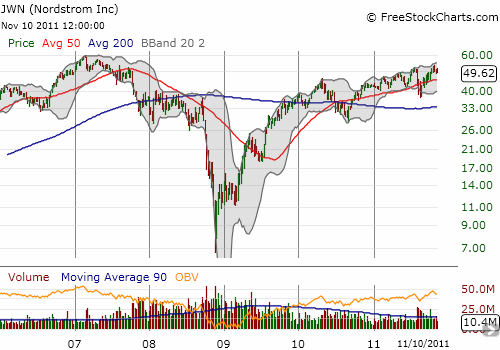

The chart below shows how Nordstrom (JWN), a retailer specializing in women’s upscale apparel, recovered almost all its losses from the recession. JWN has increased over seven times since the March lows. JWN was up as much as 23% this year and is still up 14%. Again, pretty strong for a retailer in an environment where economic malaise is the primary theme of the day.

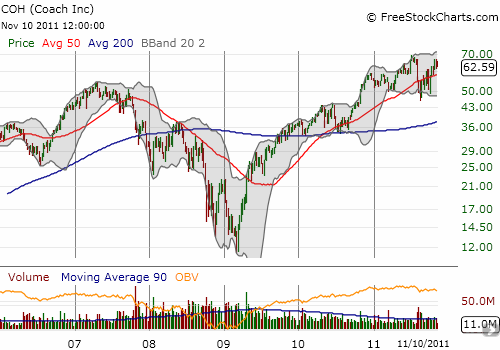

Luxury handbag retailer Coach (COH) has performed even better than Nordstrom relative to previous all-time highs. The stock managed to print new all-time highs this year and remains above the old all-time highs. Again, an impressive performance in this economic environment.

Source for all charts: FreeStockCharts.com

I sometimes find it difficult to reconcile the strong performance of these stocks with a stagnant economy. However, clearly, large enough segments of the (global) economy are doing well enough to support luxury retail, and, perhaps until a few months ago, luxurious recreation like gambling. I also wonder whether there is no need to worry about a full-blown recession until all these stocks demonstrate evidence of breaking down. I will continue closely watching all these stocks.

Be careful out there!

Full disclosure: no positions