This is an excerpt from an article I originally published on Seeking Alpha. Click here to read the entire piece.)

December 10, 2010

Netflix (NFLX) closed at $194.63.

CEO Reed Hastings scolds famous investor Whitley Tilson for shorting Netflix stock in “Netflix CEO Reed Hastings Responds to Whitney Tilson: Cover Your Short Position. Now.“:

{snip}

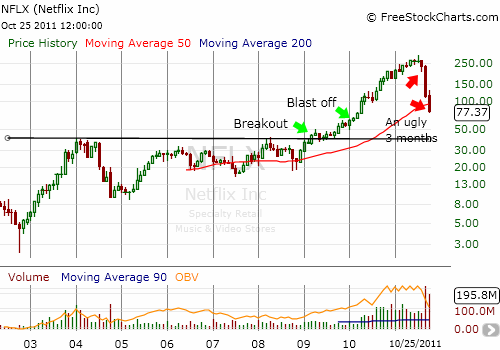

In less than a year since advising shorts like Tilson to cover, NFLX lost 60% in value while Hastings grossed at least another $40M. Hastings still owns 1.1M shares and lost about $46M in paper wealth on Tuesday. Yet, he clearly comes out the clear winner in this mess. NFLX could trade to zero, and he will still live quite well, forever and a day.

{snip}

According to Jim Cramer, the green side of the mountain bears the painful signature of massive short-covering:

{snip}

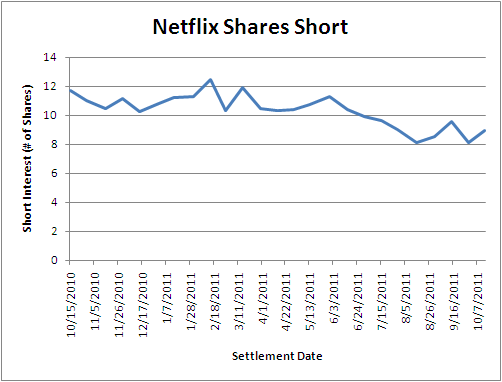

I do have a quibble with the specifics of Cramer’s characterization of the role of shorts in this mess given the data do not quite match his claims. Over the past year, shorts did decline about 24%. However, most of that decline occurred over just two months in the summer, one month before and after NFLX hit its all-time peak. Before and after this period, shorts held steady in absolute terms bouncing within a range of 2M shares.

Source: NASDAQ.com

As of September 30, shorts were still 16% of the float with 8.1M shares short. So, I find it a bit odd that Cramer goes on to blame a lack of short interest for the vacuum in buying interest that sucked NFLX down so far on Tuesday.

{snip}

Source: FreeStockCharts.com

Be careful out there!

This is an excerpt from an article I originally published on Seeking Alpha. Click here to read the entire piece.)

Full disclosure: no positions