(This is an excerpt from an article I originally published on Seeking Alpha. Click here to read the entire piece.)

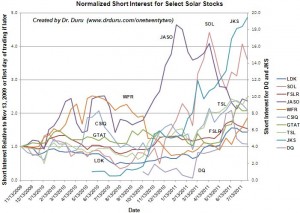

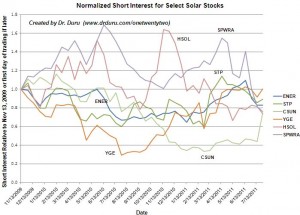

The shorts completely nailed solar stocks across the board in 2011.

{snip}

Please click on the charts to enlarge them.

Source: NASDAQ.COM

Solar bears have been very vocal, and very correct, in predicting a severe downturn in solar…{snip}…To me, the key question is what to buy and how much, not whether to pick through the rubble left of solar stocks.

Given the continued risks, going forward, I am focusing on adding to positions in just three solar stocks: First Solar (FSLR), GT Advanced Technologies (GTAT), and Trina Solar (TSL).

{snip}

The stock chart for TAN, the more liquid solar ETF (Guggenheim Solar ETF), demonstrates the overall dismal context for solar stocks.

{snip}

First Solar (FSLR)

{snip}

{snip}

GT Advanced Technologies (GTAT)

{snip}

Trina Solar (TSL)

{snip}

{snip}

LDK Solar (LDK)

I mention LDK here only because it represents one of the most disappointing solar companies of 2011.

{snip}

*All stock charts created using TeleChart

Overall, the prospects for solar look almost as grim as they did in 2008 and early 2009. However, this is the time to pick and choose these stocks as they get thrown into waste bins up and down Wall Street. Also note that I gave solar stocks a “special” mention in my playbook for a commodities crash. Most solar stocks have triggered the playbook for the past several months as they have erased their QE2-inspired gains over this time.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha. Click here to read the entire piece.)

Full disclosure: long FSLR, GTAT, TSL, JKS, SOL, JASO, and LDK