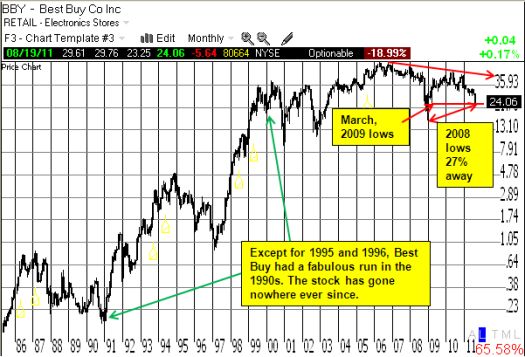

More and more stocks are hitting, and breaking, their March, 2009 and/or Fall, 2008 lows. For those people who missed out on the buying opportunities at that time, now seems like one of those rare moments where the market offers up a second chance. I am using similar logic to buy commodity-related stocks that have erased all their QE2 gains (click here for past articles). Because the stock market in general remains well-above its March, 2009 lows, the stocks completing this treacherous roundtrip may appear to be special losers rather than special bargains. Despite these concerns, there are a few I cannot resist: Best Buy (BBY) is one of them.

BBY’s March, 2009 lows were actually well above the stock’s Fall, 2008 lows. So, presumably, more downside risk remains (27%). Just like the S&P 500, BBY has now gone nowhere for about 12 years. From that perspective, there is nothing special about BBY. From a competitive perspective, Best Buy no longer has to deal with Circuit City stores across the street or in the same shopping complex, but it does have to contend with the increasing willingness of consumers to buy electronics online whether new or used. The stock’s valuation appears very attractive at 0.2 of sales and a forward P/E of 6.5 (trailing 7.8). The book value is 1.4, so if you think we are headed for a deep recession, it is reasonable to expect valuation risk goes at least to book value. Such a drop in valuation would take BBY back through its 2008 lows (31% drop). Upside opportunity should take BBY at least to the current downtrend line established from BBY’s 2006 all-time high, perhaps a 50% gain from current levels.

Overall, this is an opportunity that has enough upside opportunity to make the risk worth it. By pacing the purchase with a small amount now and a lot more in the throes of a (potential) recession, I can see this opportunity through the rough patches.

The chart below summarizes the technical picture from a multi-year, monthly, perspective.

*Chart created using TeleChart

Be careful out there!

Full disclosure: long BBY