(This is an excerpt from an article I originally published on Seeking Alpha. Click here to read the entire piece.)

Almost a month ago, Bank of England Governor Mervyn King spoke at the Lord Mayor’s Banquet for Bankers and Merchants of the City of London at the Mansion House, and I wrote afterward that the speech reminded me of almost every reason why I remain bearish on the British pound…

{snip}

…the pound is teetering on the edge of a major breakdown against the U.S. dollar. For most of 2011, the pound has held 1.590-1.595 or so as support, but that support looks ready to break soon.

{snip}

…While so much focus and attention has spotlighted the persistent and likely future weakness of the U.S. dollar, the British pound has “quietly” but surely tried to poke ahead of the U.S. in the race to the bottom of “the currency wars.” Indeed, the British pound is looking more and more like it could be the currency of choice to fund carry trades.

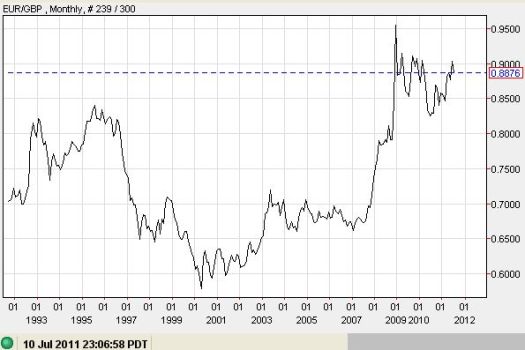

I have scaled some charts of the pound against major currencies going back to the early 1990s to demonstrate the historic nature of the pound’s nearly unabated decline:

{snip}

{snip}

{snip}

In trading the pound’s behavior, I have taken an approach of “gradualism” that involves both trend and counter-trend plays…

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha. Click here to read the entire piece.)

Full disclosure: short GBP/CHF, long GBP/USD, short EUR/GBP