(This is an excerpt from an article I originally published on Seeking Alpha. Click here to read the entire piece.)

- Trailing P/E and forward P/E both below 6

- Price/Sales below 1

- $2.12 billion in cash on the balance sheet

- Zero debt

- Double digit profit margins

Sounds like a steal, especially for a technology company (valuation metrics from Yahoo!Finance). Except this company is Research In Motion (RIMM), a company dogged by competitive pressures…

{snip}

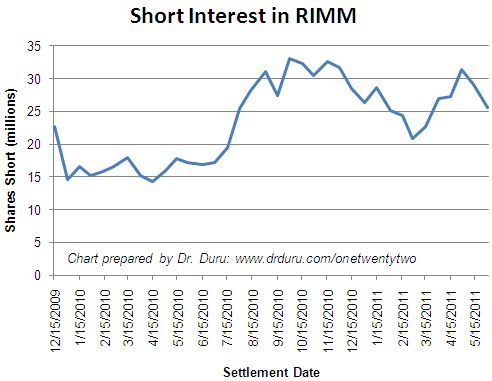

The chart below shows that shorts in RIMM increased around 50% close to multi-year highs just ahead of its earnings warning (ok – who let the news leak?). During the subsequent drop, around half that gain has been closed out (as of May 31, 2011). I was expecting short interest to continue soaring.

Source: NASDAQ.com

{snip}

The put/call ratio for RIMM reveals very little fear in the options pits for RIMM’s earnings (see Schaeffer’s Research for charts). While the put/call ratio spiked rapidly in mid-May from 0.66 to 0.80, the current levels are a far cry from the one-year high reached in February at 1.35….you guessed it, just ahead of a 10-month peak for RIMM. The stock has tumbled downhill ever since.

In other words, declining short interest and listless put buying suggest that the market, in general, is not anticipating calamity. For RIMM these days, even a “non-calamity” is good news.

{snip}

The June $37.50 call seems to provide an efficient way to dare to make this speculative bet….{snip}….

Note that in Canadian dollars, RIMM broke the dreaded “triple bottom” weeks ago…

Source: Globe and Mail

Be careful out there!

Full disclosure: long RIMM shares and puts, long AAPL