(This is an excerpt from an article I published on Seeking Alpha. Click here to read the entire piece.)

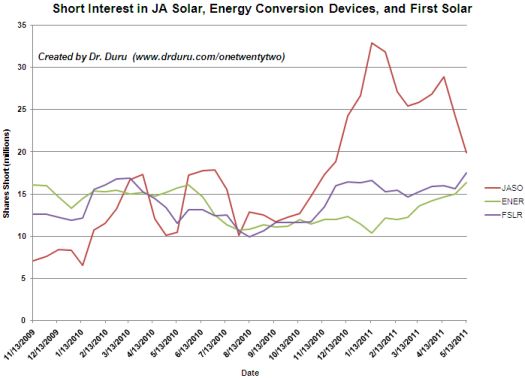

The latest short interest data are out for the two weeks ending May 13, 2010 (see list of solar short interest at NASDAQ.com). There are three main changes from my review of the health of solar companies and short interest in solar stocks in “Solar’s Debt-to-Equity Ratios Remain OK Despite Disappointing Earnings.”

{snip}

Source: NASDAQ.com

…While the short-term downtrend remains steep as FSLR follows the 20-day moving average (DMA) downward, trading on Thursday and Friday suggest some kind of bounce may finally be sustained – at least into overhead resistance levels. A “hammer” pattern, where buyers lifted FSLR well off the lows, was followed by heavy and consistent buying the next day. FSLR continues to look attractive at these levels (now for short-term swing traders as well as longer-term investors). Given shorts are 36% of the float, it will only take a small positive catalyst to get the stock lifting to ever higher prices.

Chart created using Telechart

Be careful out there!

Full disclosure: long FSLR and JASO