(This is an excerpt from an article I published on Seeking Alpha. Click here to read the entire piece.)

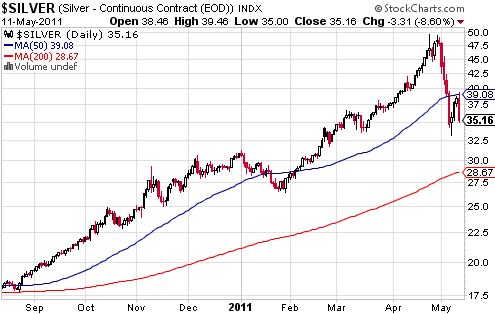

Silver failed at its 50-day moving average (DMA) resistance in spectacular fashion. Silver dropped 9% and gave up almost its entire gain from the previous three-day relief rally.

Source: stockcharts.com

As I mentioned in my previous post on silver, I think the price adjustment in silver will be on-going as several relationships revert to their means (gold and silver miners in particular). However, in the meantime, I still consider silver a buy here as long as it is accumulated in phases or stages…

…The dollar index never retested its multi-decade lows from 2008. I still think it will (and eventually fail that support), so I am inclined to think the rally ends here. If the dollar index manages to push further upward, it will be time once again to consider an extended dollar relief rally.

*Chart created using TeleChart:

…My eyes are on copper right now because it has struggled with its 50DMA for most of the year, and the metal is now struggling to hold on to support at the 200DMA. A break here could signal a significant follow-through in selling in the rest of the commodity space…

Source: stockcharts.com

(This is an excerpt from an article I published on Seeking Alpha. Click here to read the entire piece.)

Be careful out there!

Full disclosure: net short USD, long SLV, PAAS, FCX