Excerpt from an article I published on Seeking Alpha. Click here to read the entire piece:

Google (GOOG) is down 9.2% since reporting earnings April 14 and now sports a forward earnings multiple of 13. At $525, GOOG is at 7-month lows and is again close to the psychologically significant $500 price level. This combination of stats typically would motivate me to start accumulating GOOG shares again, but I took a pause after reviewing Google’s net revenue metrics.

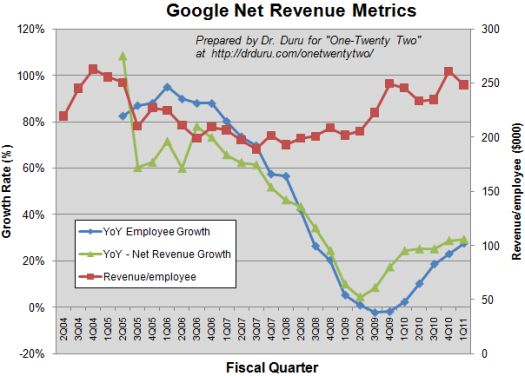

Source: Google earnings reports

…The chart above shows that GOOG has managed to nurture an upward trend in net revenue per employee (including TAC – total acquisition costs) since this metric hit bottom in late 2007. However, net revenue growth has mainly flattened out since early 2010 while employee growth has soared. If current trends continue, the upward trend in revenue/employee will end very soon. Such an end will mark a double-top in revenue/employee, making GOOG less attractive as a “value play.” GOOG’s stock will do well just to hold current levels.

So, rather than start accumulating GOOG shares here, I have decided to wait – watching for any potential resolution between buyers and sellers and/or the next one or two earnings cycles to see how revenue trends develop…

(Click here to read the rest of the article)

(Click here for an archive of GOOG commentary)

Be careful out there!

Full disclosure: no positions