I thought I would get extremely bearish once the S&P 500 reached my upside resistance target of 1300-1310. Yet here we are just five weeks into the year, and the deepest angst I can summon is an uncomfortable sense of “caution.”

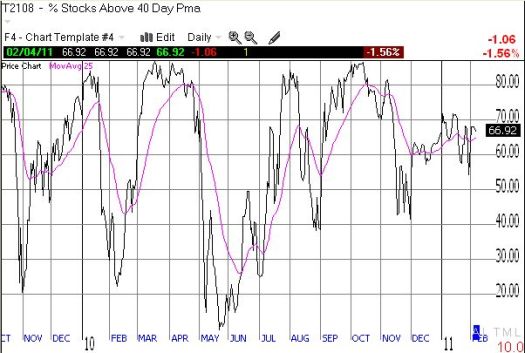

With T2108 – the percentage of stocks trading above their respective 40-day moving averages (DMA) – incredibly meandering just below 70% for this latest phase of the rally (and most of this year), the market has simply not reached the extreme I want to see before flipping my sentiment to outright bearishness.

The market appears blanketed by the liquidity-induced fog that comes from easy money – or at least that is the metaphor that helps me remember that the stock market actually has downside risk. The path of the stock market since the August lows is about as mesmerizing as it gets. A steady, nearly uninterrupted march to higher and higher prices.

*All charts created using TeleChart (except where otherwise noted):

After the markets treated the scare in Egypt like a quickly passing fad, I have to believe a unique opportunity exists for buying downside protection on the cheap. So, while I cannot get outright bearish here, I did grab a handful of SSO puts on Friday “just in case.”

Be careful out there!

Full disclosure: long SSO puts