I thought it would be fitting to close out another year of blog posts to celebrate the performance of one of my favorite investments: the Australian dollar.

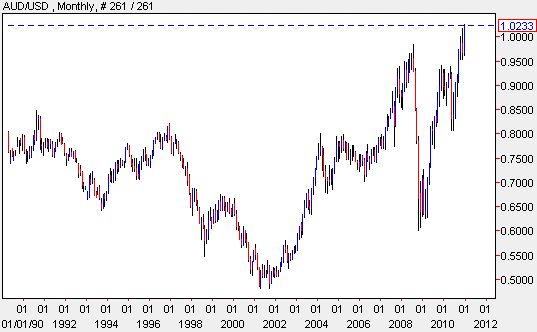

Despite beginning the week with another round of tightening by Chinese monetary authorities, the Australian dollar put on another stellar show. The “Aussie” closed the week up over 2% against the U.S. dollar. The currency made fresh all-time highs since it was freely floated against the dollar in 1983. The monthly view shows that the ride has been a wild one to get to this point (data available only to 1990).

This latest surge pushes the specter of (global) deflation ever further behind as commodities, Australia’s greatest exports, continue to gain in price and value. This strength also provides a sharp and interesting contrast to the supposed “flight for safety” seen in the fresh all-time highs printed by the Swiss franc and the stubborn strength in the yen.

The Aussie also printed yet another head and shoulders (H&S) fake-out. At the end of November, I pondered whether the Aussie had finally topped out while noting that the last H&S pattern over the summer gave way to a strong rally. This last H&S looks like it could deliver similar results.

Source for all charts: Dailyfx.com charts

The Australian dollar finishes the year up over 14% (not including interest) and now yields 4.75%. The S&P 500 will close the year up about 13% and now yields 1.9%. So, our stock market went nowhere when priced in Australian dollars – an apt metaphor for a stock market that is floating on an ever-increasing pile of printed paper. I am looking to stick to the Australian dollar in the coming year (and beyond?), especially as the U.S. Federal Reserve promises to print money to solve any future economic problems.

Be careful out there!

Full disclosure: long FXA, short GBP/AUD, long SSO puts