The stock market responded favorably to Thursday evening’s earnings report from Lender Processing Services, Inc (LPS) by sending the stock up 5%. Buying volume was also strong at 3.3 million shares, almost doubling the 1.7M 3-month average.

*Chart created using TeleChart:

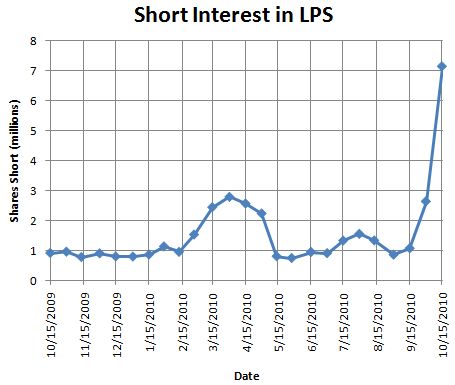

I suspect a material portion of this buying came from disappointed shorts who were looking for a smoking gun in the third quarter earnings report. As of September 15, short interest of 1.1M shares remained near the year-long steady-state. By September 30, shorts more than doubled ahead of (in anticipation of?) the explosion of “foreclosure” gate. As news about the foreclosure mess accelerated, shorts ramped their positions to 7.1M shares by October 15 (10% of float). (It is perhaps surprising that shorts were not more active given the stock has steadily declined since its all-time peak in October, 2009).

Source: NASDAQ

However, put holders remain unfazed. Two weeks ago, I noted the intriguing and persistent accumulation of March 2011 puts with a $30 strike mostly ahead of the stocks big tumble in early October. The open interest on these puts now sits at 10,128 contracts and only 5 of these puts traded on Friday in response to earnings. This inaction stands in stark contrast to the relatively strong reaction in the stock. As a result, these puts have maintained their value, vacillating around $5 for most of October after the first surge in interest.

To obtain a better context for this action, I listened to LPS’s earnings conference call and read through its supplemental material. President and CEO Jeff Carbiener did the vast majority of the talking on the conference call. He was a staunch defender of the business and tried to highlight nuggets of encouragement and business potential amidst declining industry trends (for 2010), increased regulatory pressures, litigation, and, of course, the foreclosure mess. The irony in his uplifting predictions for 2011 is that they mean a lot more pain for homeowners lies ahead.

Below I present the pieces of the presentation that most caught my interest. I did my best to transcribe quotes from the call. This is not a complete representation of all the information LPS provided.

Carbiener reiterated elements of the defense LPS issued earlier in the month by starting with the reassurance that the company is not distracted by the swirling controversy:

“The mortgage industry, including LPS, has been significantly impacted by events well-publicized in the media over the last few months. While we have attempted to address these issues as they arise, we have not lost our focus on execution, execution in a very difficult mortgage industry, and very difficult macro-economic environment.”

The defense of LPS’s involvement with Docx presented the problem as well-contained:

“…Based on results of reviews, LPS is not aware of any defects in our signing and review processes that resulted in the wrongful foreclosure of any borrower. The reviews also led our decision, for economic reasons, to begin migrating away from document preparation and signing services. We began a migration by ceasing to execute affidavits containing

borrower information, the heart of the robo-signing issue, in late 2008. Finally, our reviews led to the discovery of the signing issues previously disclosed in Docx, a small company that became part of LPS when we spun out of FIS in mid-2008. As a reminder, Docx provided document preparation services. These services included foreclosure-specific document preparation and signing services for only two mid-tier servicers from late 2008 through 2009. And in late 2009, LPS discovered that a manager of Docx had allowed some employees to sign another authorized employee’s name on certain documents with that employee’s written consent. We immediately halted the practice, dismissed the manager, re-mediated the impacted documents, forwarded the re-mediated documents to our clients or their attorneys, and closed the operation. We believe we have taken appropriate steps to re-mediate the Docx issues and again, do not believe that they resulted in the wrongful foreclosure of any borrower.

So with our decision to migrate away from document preparation and signing services, including the shutdown of Docx, we currently provide no foreclosure-related documentation preparation and signing services other than limited signing of documents in our default title operation.”

So, not only are Docx’s problems relatively minor given they did not result in any damages to homeowners, but also LPS eliminated the potential for any future problems. I suspect management realized quickly that Docx exposed the rest of the company to pains not worth its meager 1% contribution to overall revenues.

Carbiener reminded the audience that LPS has been completely forthcoming in its disclosures regarding the foreclosure mess:

“We disclosed in our 2009 10K filing that we had become aware of an inquiry from the U.S. attorney, and we have repeated that disclosure in subsequent 10Q filings. We also disclosed in our second quarter 10Q filing that we have become aware on an inquiry from the Florida attorney general. Subsequent to that disclosure, on October 13, we received a subpoena from the Florida attorney general and, like many other participants in the mortgage industry, we have recently received inquiries from other federal and state regulators. All of these inquiries appear to focus primarily on the foreclosure issues.

I just discussed and as previously disclosed, we have expressed our willingness to fully cooperate with any and all inquiries. We also continue to believe that the ultimate outcome of these inquiries will not have a negative material impact on our business or the results of operations. However, based on the increased regulatory scrutiny, of the various participants in the foreclosure process, including LPS, and given the early stages of some of these matters, it is difficult to predict the final outcome at this time. We will assess the additional impact of inquiries as they arise, and remain committed to working with all authorities in the system to understand the LPS default businesses.”

Carbiener also felt compelled to address legal issues involving foreclosure attorneys, including lawsuits in Texas and Mississippi:

“LPS does not hire foreclosure attorneys. Servicers choose the attorneys and they choose the technology that attorneys use…LPS desktop technology will route info to the specific attorneys…LPS does not participate in fee-splitting or revenue-splitting. It is not an equity owner in any law firm.”

From reviewing the financial results, I was most intrigued by the share repurchase program. LPS has been purchasing its stock all the way down in 2010. LPS has repurchased 4.9M shares year-to-date at a cost of $168M. LPS purchased half of these shares (2.3M) during Q3 costing $70.3M. During the Q&A, Carbiener told analysts that the company is getting even more aggressive as a result of the latest decline in the shares given it feels the shares are trading at “depressed levels.” The board has authorized another $250M for share repurchases – a vote of confidence that stands in sharp contrast to the tremendous ramp in short interest.

The year-over-year results were mediocre:

- 2.5% increase on adjusted net earnings (7.2% when taking into account the reduced number of shares from repurchasing activity)

- Adjusted free cash flow declined to $58.1M from $71.4M due to timing variations in working capital, tax implications, and capital expenditures

- 1.1% increase in consolidated revenues (total of $626M for the quarter)

- EBIT margins at 23.0% vs 23.2% a year ago.

Carbeiner explained that during the last 9 months, both core markets for LPS declined (default services and mortgage origination). However over this time, LPS grew revenue at 3.1%, expanded operating margins by 80 basis points, and grew adjusted earnings per share by 12.2%.

Full-year guidance for revenue growth is now 3-4% and $3.48-$3.50 earnings per diluted share. The preliminary outlook for 2011 appears good but not great: revenue growth at the lower end of a historic target range of 6-9%, while EPS should be in-line with historic target of low double-digits.

Declining metrics in the mortgage business present LPS with improved business opportunities for 2011 and into 2012. The “tea leaves” are indicating skids will get greased to push foreclosures through the system faster in the coming year. Carbeiner noted that homeowners will continue to have incentives leave properties. As a result, the market is not likely to return to historical levels of delinquency and foreclosure inventories anytime soon. These dire statistics should make almost anyone else in the housing industry groan from stomach pains (slide 6):

- Seriously delinquent loans [90+ days past due]: 2.3 million loans (historical levels approximately 500,000 loans)

- Loans currently in foreclosure process: 2.1 million loans (historical levels approximately 700,000 loans)

- Average age of seriously delinquent loans: 316 days vs.192 days in January 2008

- Limited impact on delinquent and foreclosure inventories from current government and proprietary loan modification programs

- Continued high redefault rates on all loan modification activity

- High unemployment and substantial levels of negative home equity expected to be key drivers of foreclosures well into the future

I emphasized that last point because it signifies that the management at LPS is not expecting the economy to improve much, if at all, in the near-future. This means that LPS should be a good counter-cyclical play. I am sure that was part of the thinking of spinning off the stock in the summer of 2008. However, the mortgage origination part of the business acts as the other side of the seesaw for LPS through its Technology, Data and Analytics (TD&A segment) which in the third quarter was 31% of revenue. As a result, the stock has been anything but counter-cyclical – it declined from day one of the spin-off, collapsed with the rest of the stock market in the Fall of 2008, and rode the market’s recovery from there (without a fresh low in March). 2010’s on-going decline has dragged the stock to 17-month lows while the overall market is stretching for 52-week and multi-month highs.

Overall, the jury remains in session for LPS. The stock has had negative momentum for a year. Until the content and intent of the legal inquiries becomes clear, the stock will suffer from additional overhang. However, assuming LPS’s dire predictions for the housing market pan out, LPS could become one of the market’s “bright spots” with a relatively low 7.6 forward P/E and a price-to-sales ratio of 1.1 – assuming the foreclosure mess runs its course first.

Be careful out there!

Full disclosure: long LPS put