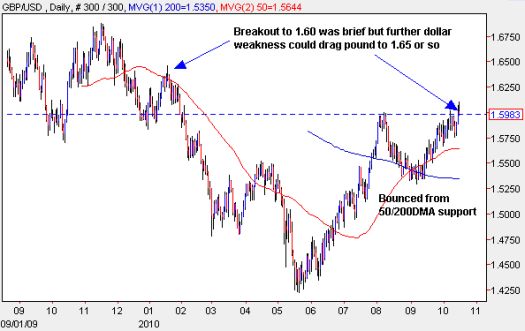

Last month, as the British pound hovered around the converging support of the 50-day moving average (DMA) and the 200DMA, I noted that the currency “awaited a catalyst” before starting a new trend versus the U.S. dollar. At the time, I suggested that catalyst depended more on dollar-related forces. Sure enough, the dollar index followed through on its breakdown on September 21, and propelled the pound upward…kicking and screaming.

Source: Dailyfx.com charts

The underwhelming nature of the pound’s rise has come from its weakness against other major currencies. If it were not for the dollar, it would be much easier to see that the market is still expecting the Bank of England to extend quantitative easing, thus weakening the pound. Here are is a summary of where the pound sits against some other major currencies:

- Versus the Swiss franc (GBP/CHF): Testing all time lows last set in fall of 2008.

- Versus the Australian dollar (GBP/AUD): Set new all-time lows.

- Versus the euro (EUR/GBP): At six month highs and up nearly 10% in almost 4 months (note this pair has the pound in the denominator).

- Versus the yen (GBP/JPY): Before the Bank of Japan’s intervention, the pound was at 4-month lows versus the yen. The pound is 2% away from a retest. Exclude 2008’s plunge, and the pound would be at 15+ year lows versus the yen.

It appears the Bank of England is almost as effective as the Federal Reserve in driving competitive devaluation.

Be careful out there!

Full disclosure: short GBP/CHF, long GBP/JPY