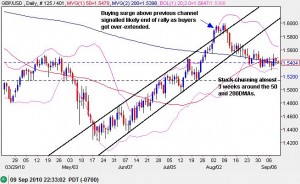

Earlier today, the Bank of England (BoE) maintained interest rates at 0.50% and did not change the size of its quantitative program… and the market essentially yawned. Such sluggish behavior has characterized the British pound’s behavior against the U.S. dollar for almost three weeks now.

Source: dailyfx.com charts (Click for larger view)

The over-extension of the pound’s rally in early August was a large red flag signaling a likely exhaustion of the buyers. While the pound is lower from the point where I claimed its rally versus the dollar was finally coming to an end, the pound barely attempted the relief rally I anticipated at the time.

So now the pound is in search of a catalyst to resolve the current impasse as range traders have a field day buying the lows and selling the highs of the GBP/USD currency pair. The next potential event to break the pound out of this pattern may be dollar-related. The dollar index continues to flirt with its critical support at its 200-day moving average and some definitive move relative to that could prod GBP/USD out of this churn. Accordingly, I am holding the GBP/USD pair long as a small hedge against my on-going EUR/USD short (I also just lightened up a bit on this short).

Be careful out there!

Full disclosure: long GBP/USD, short EUR/USD