I was very skeptical of Bernie Schaeffer’s choice of XRT, the SPDR S&P Retail ETF, as one of his top three recommendations in late November. He chose XRT as a contrarian play in the face of heavy skepticism about the health of the consumer. XRT slogged and churned for over two months before breaking out to new 52-week highs in late February; it is now up about 22% since Schaeffer’s recommendation, easily outpacing the S&P 500’s 9.4% return in that time.

In early March, I used XRT one of several indicators to suggest that the stock market seemed likely to set new 52-week highs sooner than later despite my earlier expectations that a series of climactic tops in January would put a lid on the market for months to come. My change of heart was relatively unremarkable given the general complacency that has sapped almost all selling pressure out of the stock market. (Similarly, perhaps it is not surprising that so many of bullish calls of late have turned out so well).

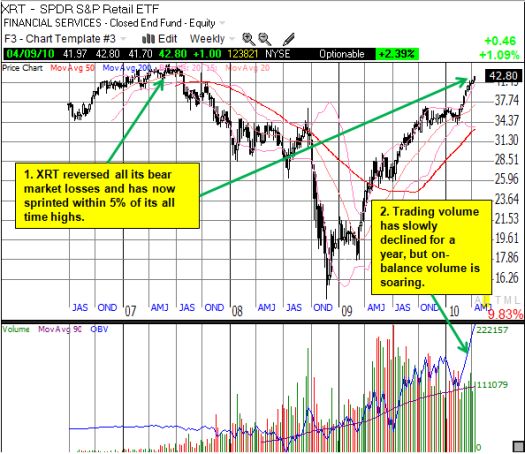

Regardless, I must marvel at the heights XRT has re-achieved. The weekly chart below shows that not only is XRT printing fresh 52-week highs week after week, but also it is approaching all-time highs (note that 2007 was the last peak in retail sales and stocks). Of all the “contrarian” plays that have favored the bulls, XRT must be one of the most gratifying given unemployment figures remain high, the housing market is not providing the equity that fueled the boom in spending just a few years ago, and, according to the Federal Reserve, credit conditions remain relatively tight throughout wide swaths of the economy. (Some skeptics point to the continued drop in sales tax collections as a sign that actual retail sales remain poor).

*Chart created using TeleChart:

The XRT is a valid indicator of market sentiment regarding retail stocks because it is a very broad index. As of April 8, XRT contains 62 stocks ranging in index weight from 1.42% to 1.89%. The ETF only holds 0.12% of its assets in cash. As the debate continues to rage about the health of the economy and the consumer, I will continue to keep XRT on the watchlist. As my good friend TraderMike fondly repeats, the chart says all…

Be careful out there!

Full disclosure: no positions