Major resistance has broken and trends are turning back up on the major indices, so it is time to consider more seriously the prospect of the market printing fresh highs on the year sooner than later. Yesterday, I examined Cummins (CMI) as one of several stocks that may indicate the market has sufficient buying power to keep pressing upward. Today, consumer-related stocks have my attention.

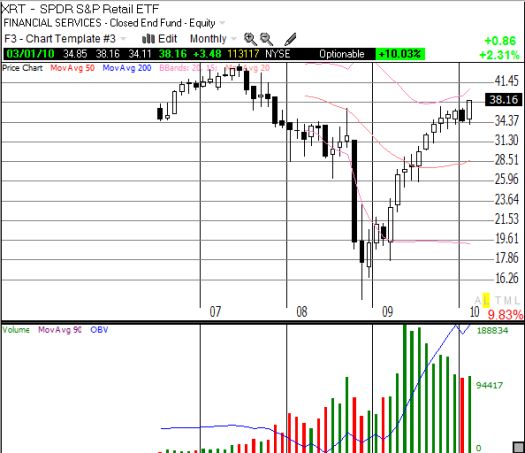

The earnings coming from retail companies continue to show surprising resilience and these data are supporting steadily increasing prices in retail stocks. The charts of retail-related ETFs suggest consumers have become increasingly bullish on their ability to support low savings rates (the consumers with jobs or working spouses anyway). In particular, the retail ETF, XRT, is trading at 28-month highs and pre-recession levels!

*All charts created using TeleChart:

Yesterday’s consumer spending data for January from the Bureau of Economic Analysis (BEA) provided the catalyst for the latest surge in retail-related stocks. The data show consumers continue to increase spending levels:

“Personal income increased $11.4 billion, or 0.1 percent, and disposable personal income (DPI) decreased $47.6 billion, or 0.4 percent, in January…The decrease in DPI reflected an increase in federal nonwithheld income taxes. Personal consumption expenditures (PCE) increased $52.4 billion, or 0.5 percent. In December, personal income increased $41.2 billion, or 0.3 percent, DPI increased $40.3 billion, or 0.4 percent, and PCE increased $26.4 billion, or 0.3 percent, based on revised estimates.

Real disposable income decreased 0.6 percent in January, in contrast to an increase of 0.2 percent in December. Real PCE increased 0.3 percent, compared with an increase of 0.1 percent.”

The BEA chart below shows that on a month-to-month basis, real personal consumption expenditures are continuing a steady recovery from depressed levels.

Source: BEA Real Personal Consumption Expenditures (March 1, 2010)

Seeing these data has to temper bearishness in the near-term, even if it is not yet clear how this kind of robust spending can be sustained given current economic conditions. (Last September, I thought a stall in the stocks of casual dining stocks suggested an imminent end to the consumer’s recovery.). Interestingly, these very same consumers remain tepid supporters of the stock market. Wall Street is trying its old-fashioned best to seduce Americans back into stocks, but to-date these efforts are not working well.

Data from the Investment Company Institute (ICI) (as of the week of February 17) show that after a brief surge to start the year, cash flows into equity mutual funds returned to anemic levels the past four weeks. Two of these weeks experienced significant outflows. It is probably no accident that these two weeks of outflows came AFTER the big drawdown in stocks in the second half of January. It will be interesting to see whether new highs in the market pushes another surge of cash into mutual funds. Note well that the last FOUR months of 2009 featured net outflows of cash from equity mutual funds.

Be careful out there!

Full disclosure: no positions