I am always on the hunt for trading opportunities in solar stocks. For a third time, ReneSola (SOL) appears to be a long opportunity. My previous two attempts failed as I bought calls instead of shares. Purchasing shares instead of calls would have left me flat at this point. I am looking for a charmed third time with SOL.

Both SOL’s post-earnings performance and the technical set-up caught my eye this time.

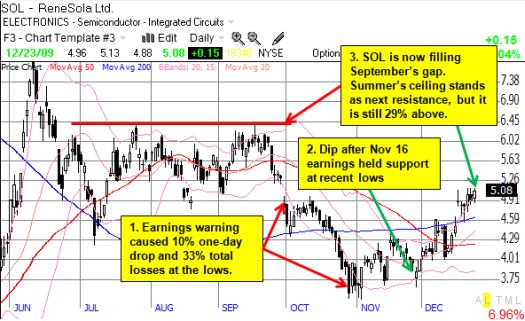

SOL is now up 18% since reporting earnings on November 16 when the company generated record product shipments and revenue above guidance. The outlook appeared very positive and was a lot more optimistic than I could have expected given the earnings warning that SOL produced at the end of September:

“We were pleased to see strong improvements in revenues and shipment volumes during the third quarter as we continue to witness strong customer demand and continue to gain market share globally. We are one quarter away from completely working through our high cost inventories. As such, we expect substantial margin improvements and a return to profitability in Q1 2010.”

The post-earnings bounce off the recent lows (and lower Bollinger Band) were the early buy signals, but I missed those. Now, SOL has moved above both the 50-day moving average (DMA) and 200DMA. I am looking for both to provide firmer support this time. The chart below summarizes the current (price-only) technical set-up:

*Chart created using TeleChart:

The clincher was strong call activity on Monday. Schaeffer’s noticed it too:

“Short-term option traders are betting on additional upside for the shares of ReneSola Ltd. as indicated by today’s surge in front-month call activity. So far today, the China-based manufacturer of solar wafers has seen more than 1,500 calls cross the tape – nearly tripling the norm – with more than half of the calls changing hands at the ask price, suggesting they were likely bought.

The influx in call buying echoes the recent trend on the International Securities Exchange (ISE), where speculators during the past couple of weeks have bought to open more than 69 times as many SOL calls as puts.”

The January 2010 calls at the 5 strike experienced the bulk of the action. I purchased those on Tuesday as SOL fell back slightly from Monday’s strong performance. Depending on how trading and industry events unfold in the next month, I may consider finally buying shares and hanging onto them for a while.

Be careful out there!

Full disclosure: long SOL calls