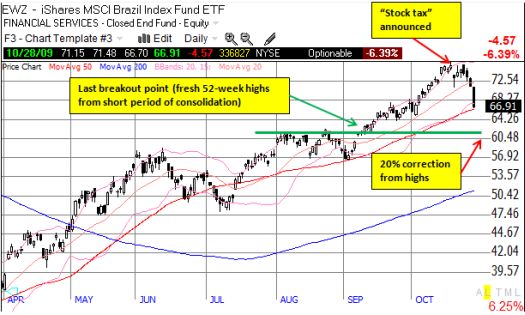

The current correction has produced a LOT of intriguing charts. The Brazil Index Fund ETF, EWZ, is certainly one of them (shown below). EWZ suffered its largest one-day drop since March, and it has now completed a roundtrip for its Olympics-driven rally. EWZ is now already down 12% from its closing 14-month high just last week.

Shortly after Brazil won the privilege of hosting the 2016 Olympic Summer Games, I wrote that Brazil presented much greater investment potential than the U.S. I am treating this correction as an attractive buying opportunity. I suspect that EWZ will reverse at least 20% from its highs. That point just happens to be $62 which represents the location of the last breakout from consolidation to fresh 52-week highs and a new rally.

See chart below:

*Chart created using TeleChart:

Note well that Brazil recently proposed a 2% capital tax on foreign investments in an effort to raise revenues, stop the appreciation in the real (Brazil’s currency), and prevent an asset bubble. This announcement marked a top in EWZ, but a 20% or more correction should be more than enough buffer for this bump in the road.

Be careful out there!

Full disclosure: Long TNE

1 thought on “Olympics Rally Ends for the Brazil Index Fund”