Share Click here to suggest a topic using Skribit. Search past articles here.

By now, you should know the routine: Pull out your favorite market sentiment indicators and track just how bad things get before some kind of turn occurs. For the nth time since we first learned that HBC was hobbled by bad bets in subprime mortgages, anyone who cares about the financial markets is on "oversold watch." We are waiting for that magical moment when fear seems to be at its maximum, all hope seems lost, and the world as we know it seems be twisted into an unrecognizable mess. It is a moment when everyone stops fighting the market and decides all at once that the market is indeed right and is forecasting a bottomless pit. Yet, it is also a moment when people who write and read about the markets want everyone else to be the last seller.

As you faithful readers know, I always check in on T2108 in times like these. T2108 measures the percentage of stocks below their 40DMA. TraderMike points out that it finally cracked 20% and slammed down to 15% on Wednesday. 20% is the level where the risk/reward for new shorts starts to look poor, and prudent bears start to close out positions. Note however, that it is not automatically the time to start buying stocks although folks with large pockets and long timeframes can be excused for starting to nibble on favorite stocks from a carefully crafted watchlist. Low T2108 readings often coincide with spikes in the VIX, the volatility index also warmly known as the "fear gauge." Sure enough, the VIX closed on the high at 36. This level has only been surpassed twice since the VIX bottomed in late 2006. Under these conditions, I would ordinarily be looking for additional technical confirmations of an imminent (bear market) bounce. But these days, I am lot more circumspect.

My biggest alarm is that the July lows were already historic relative to other climactic lows over the past 22 years. Back in July, I noted that only the October, 1987 crash and the Iraqi invasion of Kuwait generated more trading days with the T2108 under the 20% level. When the market finally got over those tumultuous days, it never looked back. This time around, we got a historic and cataclysmic low that featured a low-volume rally and a violation of the low within two short months. When I suggested in August that it might be time to sell the bear market bounce, I never even thought about us getting to a point like this and especially not this fast! Either we are about to embark on yet another historic bottoming process, and/or we have several more climactic lows at lower levels before we turn around this battleship.

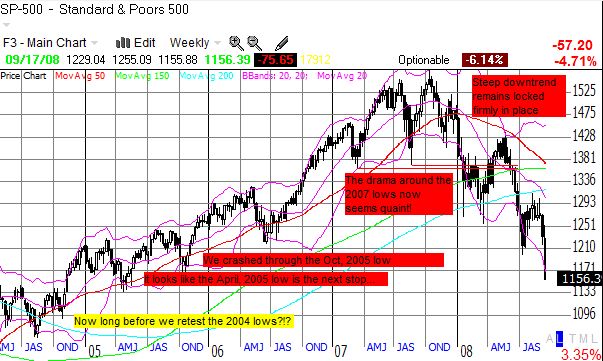

My next alarm is that Tuesday's post-Fed bounce happened right after the S&P 500 touched an important support level formed by the sharp correction in October, 2005, but that support did not last. We violated that support right away on Wednesday and sold hard into the close with the VIX spiking. Typically, the more technically-inclined traders start buying (and holding) as soon as the VIX makes the kind of spike it did on Wednesday. The next support is around 1140 formed by a sharp correction in April, 2005. We are barely 1% above that level now and hitting that level will probably come with the VIX hitting 40 or greater. Note that the two sharp corrections in 2005 came amidst fears of recession and a global slowdown. The market eventually moved on and decided to ignore the topping process that was underway in housing at the time. Yes, the market's much-touted discounting mechanism can fail miserably.

These two alarms have me thinking aloud about an end game that could still be months, even years, in the making. When the tech bubble burst, the NASDAQ did not bottom until it gave up the last four years of bubble-blown gains. Since the housing bubble burst, the homebuilder stocks have essentially returned ALL of their gains; many homebuilders have hit prices last seen in 2000 and 2001 (Toll Brothers (TOL) has been a notable and resilient exception). Now that America's credit bubble has popped, we need to ask ourselves how much of our economy has been driven by the excessive use of leverage and debt? In the Wall Street Journal's front cover story - "Worst Crisis Since '30s, With No End Yet in Sight" - we find out that "Between 2002 and 2006, household borrowing grew at an average annual rate of 11%, far outpacing overall economic growth. Borrowing by financial institutions grew by a 10% annualized rate." Another way to think about this data is that our economy has been so weak all these years, it took massive amounts of borrowing just to generate modest to average GDP growth. So, we should expect the deleveraging that is part of the unwind of the credit bubble to destroy much of the profits made during this period. On the S&P 500, we are already back to prices last seen in 2005. 2004's lows were around 1060. That is "only" another 8% down from here, and would mark a 32% drop from the highs made last year. Such a drop is well-within the range of a typical bear market as measured from peak to trough. I am not yet ready to consider even more drastic scenarios. However, I have already pointed out in earlier missives (for example, in "Driving the Economy with Negative Savings Rates") that it seems that the entire bull market that started from 1982 was supported by getting Americans to save a lot less and to consume a lot more than we did in the generation prior. The first decade of this century seems to be the unhappy pinnacle of our historic consumption binge.

This all means I now have a new target to watch for on the S&P 500: 1060. September's action has essentially invalidated my earlier guess that the bear market bounce from July would eventually take us to the May highs before year-end. Assuming I am correct this time, 2008 will only be the 7th year since 1962 where the May highs were never seen again for the remainder of the year.

While I remain quite bearish on the market, I also recognize that each bear market bounce will present its own set of opportunities. The last bear market bounce was particularly kind to financial and retail stocks. Perhaps the next bear market bounce will feature technology and commodity stocks. I say this because technology will be seen as more "immune" from the wreck in the financial sector (regardless of whether it is true or not), and commodities will be big beneficiaries of renewed global efforts to debase currencies to stoke growth. In previous missives, I have reviewed the confident claims of many executives in commodity-related companies who reassured us that the global story was just fine. We finally got one clear data point from a company that undermines the global growth story. Monday night, Dell (DELL) warned that "The company is seeing further softening in global end-user demand in the current quarter", including Western Europe and several Asian countries. I sat up and took notice because DELL had just reported earnings three weeks ago, and DELL's CEO purchased a whopping 4.9 million shares a mere 10 days earlier! So things must REALLY be bad for DELL to be providing such an early warning. I stood up and took notice when Briefing.com reported from the subsequent conference call that DELL's CFO warned "...China is not snapping back."

Indeed, China had cut interest rates earlier that day. Presumably, China cut rates because growth is slowing dangerously enough to ignore inflation-fighting for now. So, "something" is wrong with China's growth story and that should have bad implications for the global growth story in general. (It also had bad implications for my portfolio as I got caught holding DELL shares trying to follow Michael Dell's lead in purchasing his company's shares. Fortunately, I was mostly hedged with puts). I expect that the next bear bounce from oversold conditions will be all about stabilizing America's financial system. But the next bump will come from increasing recognition that the U.S., and perhaps the globe, is entering an extended period of slow (or slower) economic growth. (Recall that the U.S. economy now seems to need a lot of debt to generate every dollar of growth. Reduce and/or take away that leverage, and =poof=, there goes growth.)

Going forward, I will be more focused than ever on commodity-related plays. China has supposedly asked the world to start considering a substitute to the American dollar as the world's reserve currency. I have stated several times on these pages that I have little faith in the U.S. dollar, and this news is just one more confirmation for me. Our debts to the world are simply too high to sustain a world-class currency. The historic one-day 11% pop in gold finally provided some vindication to my recent accumulation of gold. I believe there are many more fireworks to come, both up and down. I also remain steadfastly bullish on oil and added to my USO position earlier this week. I consider any barrel below $100 to be too cheap to pass up. (Dennis Gartman has now flipped more bullish on gold and oil as well). I have my eyes on all the other names I have mentioned in earlier missives.

Be careful out there!

(Sidebar: For giggles, check out CNBC's Dylan Ratigan and Maria Bartiromo rip into Jay Dhru from Standard & Poor's over the culpability of the ratings agencies in the current credit crisis. For those of us who care about such things, I consider this 10-minute piece a CLASSIC).

Full disclosure: Long S&P 500 in an index mutual fund (hedged), USO, GLD, DELL (hedged). For other disclaimers click here.

Share