Click here to suggest a topic using Skribit. Search past articles here.

Those of us who dare to prognosticate about the market and then double-dare to use technical analysis to do the prognosticating have been amazed at how deeply oversold the market has gotten without an accompanying spike in the VIX (volatility index). We have become accustomed to seeing the VIX spike at major market bottoms. Major market bottoms have also occurred with a low in the percentage of NYSE stocks below their 40-day moving averages, also known as T2108. So now that we are getting a deep low on T2108, the question is whether we actually need to see a spike in the VIX for a (short-term) bottom to happen.

First, let's put the T2108 into historical perspective. My data on T2108 goes back to 1986. I discovered two major points:

- Over the past 22 years, we have only had 50 trading days with lower T2108 readings than the current reading of 9.26%. 32 of those days (64%) came in the aftermath of the October, 1987 crash. The rest of these days cover major climactic moments from the past 20 years: the trading days after the stock market re-opened after 9/11, the Long-Term Capital Management (LTCM) collapse in 1998, the last bear market lows in July, 2002, the first week of Iraq's invasion of Kuwait in August, 1990, and a climactic bottom on April 4, 1994 as interest rates were raised in the middle of a strong bull market. That is some impressive company!

- We have now spent 7 trading days below 20% on T2108. 20% is considered oversold territory and the point at which new shorts typically represent poor risk/reward. The market tends to spend precious little time under 20%. The October 1987 crash gave us an incredible 42 trading days below 20% on T2108. There have only been 13 other occasions where the stock market spent at least 7 trading days below these levels. Most were clustered around the events described above. The second longest period was 19 days during the Iraqi invasion of Kuwait.

Now, what intrigues me the most is the relationship between T2108 and the VIX. Using T2108 allows me to isolate climactic bottoms where the market experiences an extraordinary flurry of selling as opposed to the ordinary dips that come and go with normal market fluctuations. As the "gauge of fear" the VIX is used to measure overall negative sentiment although it is based on the S&P 500. Since these indicators are drawn from different populations of stocks, there is no fundamental reason why a T2108 bottom should coincide exactly with a spike in the VIX. Additionally, I have daily open/close and low/high info on the VIX, but only close info on T2108. But since both indicators are so closely watched by technicians and fundamentalists alike, I thought I would dig around and see what happens. What does the historical record tell us about lows in T2108 versus the VIX?

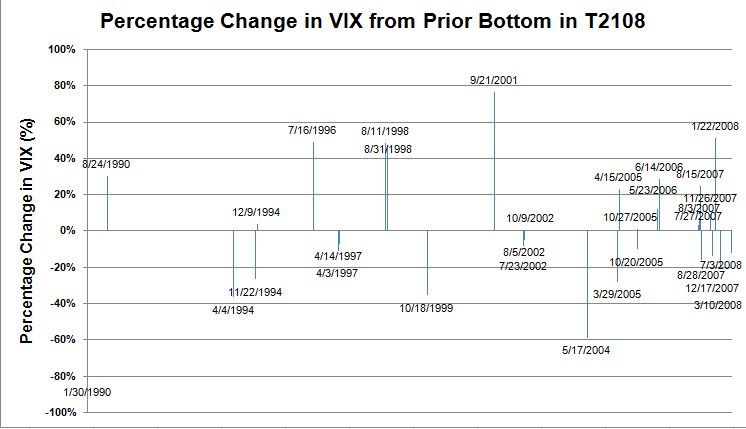

Well, over the past 22 years it appears that we cannot count on a direct relationship between the VIX at a T2108 bottom and prior bottoms. I counted out 31 lows in T2108 where the indicator dipped below 20%. Sometimes, lows occurred within weeks as the market violently swung up and down before launching a more sustained rally. For each low, I recorded the high of the VIX and compared it to the high of the VIX at the previous low in T2108. In other words, I defined a "spike" in the VIX in relation to prior spikes. The chart below shows this percentage change in the VIX on the y-axis with the date on the x-axis. Rather than crowd the dates on the x-axis, I simply labeled each T2108 low with the date of its occurrence.

Note that the large drop in the VIX on January 30, 1990 is from a comparison with the historic spike in October, 1987. But even when we throw that data point out, we see that the VIX at the moment of a T2108 bottom can be significantly lower than previous bottoms. It is very possible for the market to pass you by while you are staring at the VIX compared to recent bottoms. However, we could say that if the VIX gets within 20% of prior spikes, then you have a "close enough" confirmation of a climactic (T2108) bottom. March's VIX spike went as high as 35.60. The "close-enough" point then is 28.5. We got to 26 last Wednesday...

Something else turned up in this chart that I was not even looking for. Note how crowded the T2108 lows become starting in 2005. The last bear market (say 2000-2003) only had 4 climactic bottoms as measured by T2108. But in just the last 3 years we have seen 15. Perhaps this violent behavior alone could have told us that something was "wrong" with the bull market. Traders and investors alike have been very quick to sell stocks at the first sign of trouble. Until now, this tentative behavior was masked by swift and sustained rallies that brought new excitement to the market. Gains in the market have been built on the pains of numerous panics. But in the past year or so, we have suffered through one false rally after another. Excitement is waning.

So, will we see a spike in the VIX similar to previous climactic lows before we get another climactic low and subsequent (short-term?) rally? This analysis seems to say that a VIX spike is a sufficient condition, but it is not a necessary condition. "Close enough" on the VIX and a T2108 reading below 20% is as close to a ringing bell as you need. And with T2108 below 10% and a VIX close enough, you sure do not want to get caught short - in more ways than one.

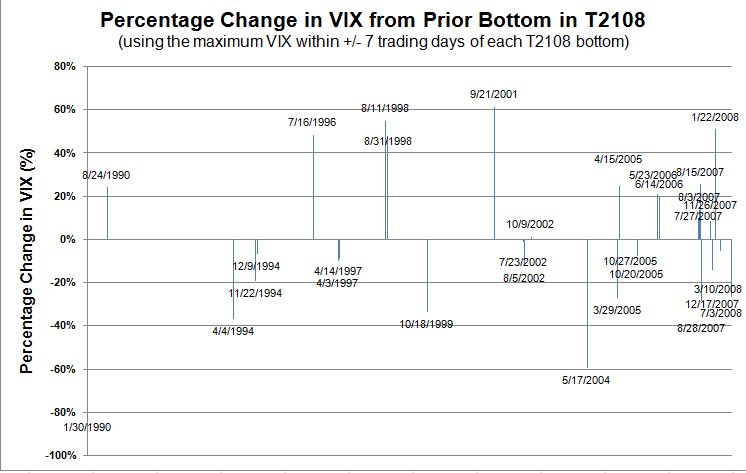

The March, 2008 lows are a case in point on how sloppy the correlations can get. T2108 bottomed on March 10 with the VIX hitting a high of 29.7. The S&P made a new closing low that turned out to be the bottom CLOSE. A week later, on March 17th, the S&P 500 made a new low but not a new closing low, and the VIX spiked higher to 35.6. T2108 did not make a new low. March 10th was "close enough," but you would have had to grit your teeth hard to see your positions through to profit. Also recognize that you never know the limits of these moves until you are looking backward. To try to account for this potential lag, I took each low in the T2108 and looked for the maximum VIX reading within 7 trading days before or after the climactic low. The chart below now shows the percentage change in VIX from the prior bottom using this new maximum VIX within 7 trading days. There are differences with specific dates, but overall, the conclusions remain the same as I stated above.

Finally, none of this tells you anything about the rally's sustainability or durability...of course.

Be careful out there!

Full disclosure: Long S&P 500 in a index mutual fund. For other disclaimers click here.