Click here to suggest a topic using Skribit. Search past articles here.

Four months after I laid out the case for the S&P 500 hitting 1200, the market finally obliged on Tuesday with a low of 1200.44. 1200 was my target low for 2008, so now what? I say prepare for a classic bear market rally.

The timing of this low and the stock market's subsequent sharp bounce have been almost picture perfect. The headlines almost cannot get worse at this point. You know the deal: IndyMac becomes the second largest bank failure in U.S. history, Fannie and Freddie cling on for dear life with trillions in mortgage debt in the balance, a looming potential showdown between Iran and Israel, the U.S. starting to lose ground in Afghanistan, oil continuing to hit new records, stocks of regional banks experience their largest drops since the 1930s, Europe tipping into recession (for example, on Wednesday we learn that monthly unemployment numbers in the UK are the worst since 1992), short sellers are destroying the American way of life, Americans are wondering whether we really have a socialist economy given all the government intervention and taxpayer money that has been required to prop up this whole game, and on Wednesday morning we got hit with news that both headline and core consumer price inflation (CPI) surpassed expectations - the headline number at 5% over the past year is the worst since 1991. And that was all we needed to kick off a monster bear market rally day. (oh yeah - and the National Association of Home Builders reported that its indicator of builder confidence hit another record low in July).

On Monday, the market faded hard after first rallying on the government's plan to "save" Freddie and Fannie. Upon seeing that, I had to hold my nose and add to the 401K mutual funds. I was a tad early for this particular climactic low, but conditions seemed so dark and gloomy and so oversold, I felt compelled to put long-term cash to work (so much of it has been sitting idle and continues to do so). I essentially decided that I am going to cling on for dear life through this ugly cycle (sorry - I will not be one of the famous capitulators everyone wants to befriend but no one wants to join). I normally would dare to declare the low for this cycle but with inflation continuing to rise unabated, no sign of job growth in sight, a handcuffed Fed, and the crumbling of the global growth story into the vortex of America's desperate need for cash infusions, financing, and re-financing, I must remain humble, respect the bear, and keep plenty of powder dry. So why do anything at all? Well, because every climactic low carries with it some decent probability that it will hold for the cycle. In my humble opinion, this climactic low is incrementally more convincing than all the previous five put together. So, risk/reward tells me I have to at least nibble here. Let's review how low we are now that my target on the S&P 500 has been tapped.

Coincident with the S&P 500 hitting 1200 we finally had both the Russell 2000 and the NASDAQ successfully retest their 52-week lows. These two indices had particularly impressive one-day moonshots on Wednesday: they each erased almost all of July's losses. See charts below:

We also reached new historic technical measures for an oversold market. T2108, the percentage of stocks above their 40-day moving average, has been under 20% for 15 straight days now. This is the third longest streak over the 22 years of history that I have. Only the crash of 1987 and the Iraqi invasion of Kuwait in 1990 provided longer streaks (see "Does the VIX Need to Spike at A Climactic Low?" for a review of this data). I have been trying not to focus too much on the VIX, but I cannot help but notice that on Tuesday we finally breached 30 (I earlier argued that 28 would be "good enough") and for the past five days the VIX has closed off its highs, sometimes quite swiftly and sharply. I was also very intrigued to hear important companies like Intel (INTC) and CSX Corporation (CSX) speak well of their economic prospects. I will be looking for more positive claims over this July earnings cycle - with a skeptical eye of course.

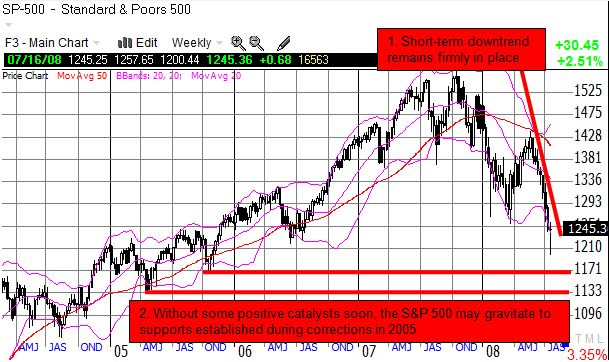

And now for a dose of cold reality. The S&P 500 is still firmly locked in the cold grip of a short-term downtrend. 1200 marks the lows of a steep correction in the fall of 2005 - but the intraday low was actually around 1168. 1200 is just a happy round number to target. A correction in the Spring of that year took the S&P 500 to 1136 and would be the next point of support. (see the weekly chart below):

(On a quick side note, I will point out that the Dow has now confirmed the false break-out in 2006 to new all-time highs. That old high was set in January 2000 around 11,600. It was first broken in May, 2006, and another break in September 2006 ignited a one-year rally that has of course now completely blown up. I expect this number to remain an important psychological barrier/support for the Dow this year).

What I want to see on Thursday is a market full of eager beavers who want to hop on the bandwagon before the train leaves the station. The extent to which buyers are given another shot at Tuesday's and Wednesday's "firesales" will tell me just how tenuous and shaky are the hands that have attempted to put in another climactic low in the market. If we quickly retrace Wednesday's gains, then all bets are off again. And as always, breaks of support further confirm the depths of the bear that has set upon us. Since this week is an options expiration week, we could see some very wild action before we get some resolution.

Another dose of cold reality is that a steep 2-day drop in oil helped fuel the market's jets on Wednesday. Yet, oil is only back to May's highs and June's breakout, so I am nowhere close to excited about that as a catalyst for higher stock prices. I look across the collection of materials and commodity stocks and see profits being cashed in and recession bets being placed. The swift July 2nd one-day collapse in steel, coal, and copper remains intact and largely unchallenged (Cleveland Cliffs (CLF) looked ready until they made a big power move on Alpha Natural Resources (ANR)). Even the long uptrend in natural gas appears to finally be broken (charts not shown). The combination of these drops will certainly get the market excited about the prospect of tamer inflation, and we should see a sympathetic rise in stocks. But I firmly suspect that a continuation of these drops will be strong indicators of future global economic weakness. The tale of a decoupled global economy that could soar without the United States has been proven to be so much fiction as global stock markets have been sinking in lockstep with the U.S. But if global growth stumbles this year, the U.S. economy will lose its last prop before the domestic scene is anywhere close to healthy. Also, inflation may remain with us for some time as the government looks for more creative ways of injecting cash into a collapsing financial sector (aka print money). I noted the imminent break-out in gold at the end of June and will look for spots for bulking up my position in GLD. It is almost looking like the last man standing at the party. Since that missive, I have also been in and out of Goldcorp (GG) to great effect, and I am eagerly tracking the 2-day (so far) sell-off in the stock.

Finally, on June 22, I made the case for prolonged weakness in the S&P 500. The overhead resistance is thick on all the major indices, not to mention all the headwinds coming from the negative headlines I mentioned above. I fully expect tough sledding going forward even if this week proves to be a lasting bottom. My upside expectations are quite subdued for now.

So overall, respect the bear; recognize that anything you do here has some real risk, and at this point, more risk than "usual"; understand your timeframes, and, most of all, be careful out there!

Full disclosure: Long S&P 500 in an index mutual fund. Long QLD and GLD. For other disclaimers click here.