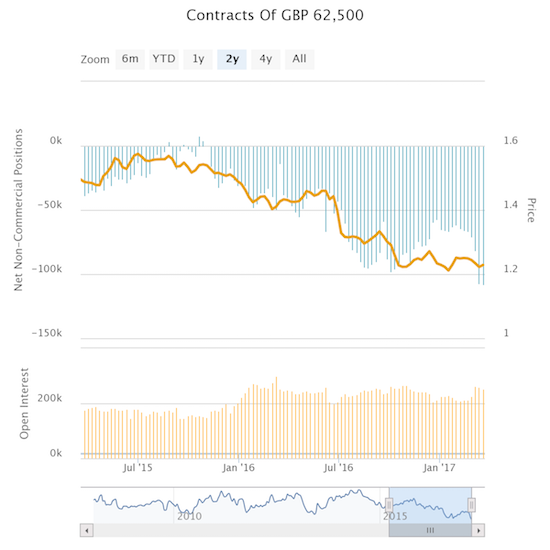

A week ago, the CFTC’s Commitments of Traders report revealed that speculators had ramped up net short contracts to highs unseen since at least 2008. These positions were accumulated ahead of announcements on monetary policy from the Bank of England and the U.S. Federal Reserve. Given the British pound soared through these events, I assumed that a short squeezed drove the surge. It turns out that speculators held firm through the rally.

Source: Oanda’s CFTC’s Commitments of Traders

Speculators are now apparently holding firm ahead of this week’s well-anticipated triggering of Article 50. This event will officially begin the United Kingdom’s exit from the European Union (EU). When UK Prime Minister Theresa May makes the declaration on March 29th, the UK government will proceed to convert EU law into UK law and launch negotiations with the EU. Will the kick-off experience enough bumps to cause the British pound to reverse its on-going rally? Speculators seem to be betting so (or something similar). I continue to follow the speculators in fading the British pound; I am now eyeing a test of overhead, downtrending resistance at the 200DMA for GBP/USD. I will re-evaluate all my pound short positions if GBP/USD slices through this resistance.

Despite the approach of Article 50, relative interest in Brexit remains well off levels from the beginning of 2017.

Be careful out there!

Full disclosure: net short the British pound in forex, long FXB