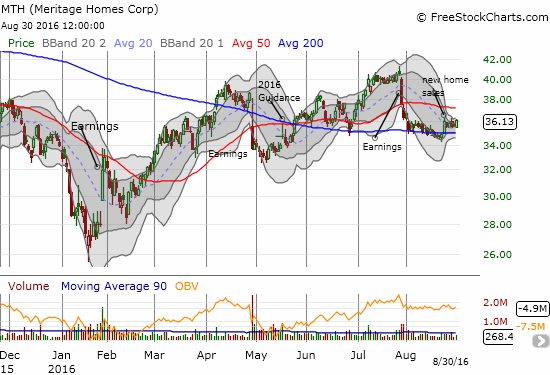

Three months ago, I reviewed earnings guidance from Meritage Homes (MTH) for second quarter 2016. The guidance and subsequent positive market reaction came within weeks of a first quarter earnings report that was very poorly received (13% loss on the day). I called the guidance “too late” because of the sour taste left by the Q1 report that failed to provide guidance when analysts were chomping at the bit to get it.

MTH managed to continue its recovery from that sell-off and even hit a new (marginal) high for 2016. The excitement turned out to be premature as MTH’s earnings report on July 28th for 2Q results disappointed to the tune of a 7.4% loss on the day. MTH is now trying to hold on to technical support at its 200-day moving average (DMA).

Source: FreeStockCharts.com

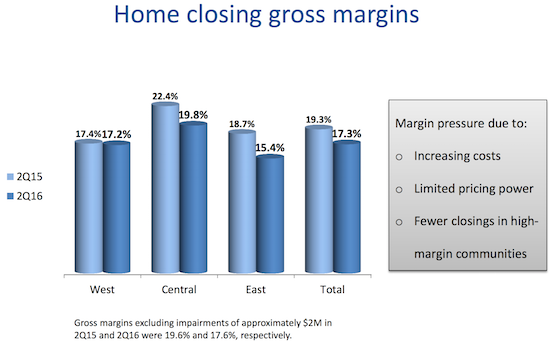

Based on the barrage of analyst questions on the conference call margins were once again the big issue. MTH disappointed on this score and projected that it is not likely to do a lot better in the second half of the year. The margin story from the earnings report:

Second quarter: “Second quarter home closing gross margin was 17.3% in 2016 (17.6% before impairments), compared to 19.3% in 2015 (19.6% before impairments), primarily reflecting higher land and labor costs, in addition to fewer closings of homes in high-margin communities.”

Year-to-date: “Gross margin was 17.3% in the first half of 2016 compared to 18.9% in 2015, reflecting continued cost and pricing headwinds.”

Projections: “We expect home closing gross margins of approximately 17.5-18.0% for the third quarter and for the year.”

MTH last guided as follows: “Home closing gross margin of approximately 18-18.5% for the year, compared to 19% in 2015, and mid-17-18% in the second quarter, compared to 19.3% in the prior year.”

Source: Meritage Homes

The misses look minor but the reasons for the misses are important. They were clearly enough to spook investors into another one-day sell-off (-7.4%) on the stock. However, the small tick down in margin guidance did not move the needle on MTH’s earnings guidance for the year even as revenue guidance remained the same. From the earnings report (emphasis mine):

“Based on our outlook and the results for the first half of the year, we are reiterating our projections for 2016 full year orders, closings, revenue and diluted earnings per share, while adjusting our expectations for the timing of improvements in gross margin due to limited pricing power to offset rising costs. We are also providing our third quarter projections, including approximately 1,600-1,800 orders, which should result in 7,350-7,550 orders for the year. We also project 1,750-1,850 homes closings in the third quarter for home closing revenue of $740-760 million, and 7,300-7,600 closings for revenue of $2.9-3.1 billion for the year….With those projections, we expect to deliver diluted EPS of $0.80-0.85 for the third quarter and $3.55-3.85 for the year.”

MTH sold $2.5B in home closing revenue in 2015 which means the company expects a 2016 growth rate of a very respectable 16% to 24%. MTH earned $3.09/share in 2015. Assuming projections ring true, MTH thus expects a 15% to 25% annual earnings growth rate. With an expected P/E for 2016 of 10.2 to 10.7, MTH looks pretty cheap. Current price-to-book is only 1.1 and price-to-sales is a paltry 0.5. MTH looks priced to buy! However, the heavy disappointment over margins promises to create a lasting overhang. I think investors and analysts obsess over home builder margins so much because declining margins might provide an early warning signal of a downturn. Market expectations for a rate hike in December are likely adding to the overhang. So, despite the cheap valuation for MTH, I am staying on hold until 1) the next big sell-off, and/or 2) November or so when the seasonally strong period for home builders begins.

I think MTH’s expansion plans are also worrying analysts to some extent. Perhaps the prospect of an increased footprint with first-time home buyers has analysts worrying about yet more margin pressure. MTH plans to increase its mix of “entry plus” homes to 35% to 40% over the next few years. Margins in entry level homes will not likely surpass current levels and thus should place a cap on future margin growth. However, MTH management was quite emphatic about its focus on getting margins higher…to the point of clear irritation with the doubt and skepticism implied by analysts. This dynamic repeated a theme from the last earnings call. From Chairman & CEO Steve Hilton (quotes from the earnings call from the Seeking Alpha transcript):

“Michael, I could tell you right out of the chute, there’s nobody more keenly aware of the margin issue than I am. Okay? I have operated for 30 years at subsequently higher margins than we’re achieving today.

And I wake up every single morning thinking about how can I get those margins up because I absolutely understand it’s a big issue. It’s a cost issue; it’s a land issue. It’s some underperforming communities issue due to the FHA issue that I outlined before in the West and we’re working as hard as we can to fix it as fast as we can to get our margins back up to where they need to be. But I can’t give you any more color than that. I mean, at some point, we’ll get them back up in line with some of our competitors. But I can’t tell you what quarter that’s going to be.

…we don’t take it lightly. We’re very serious about trying to get that number higher — this is not the new norm.”

On the positive side, I was pleasantly surprised with MTH’s results in its Western region, particularly in California. I identified the West as a potential trouble spot in my Housing Market Reviews, and I was hoping to find some reassurance in the reports of individual home builders. Outside of the margin issues, MTH reported strong results and on-going confidence with business in California…

“Demand remains strongest in California and Colorado which has the highest absorption pace across the entire country at 11.8 and 13 homes per community on average, respectively, compared to our Company average of 8.6. “

MTH also indicated that most of its capital investment in the West will go to California.

Texas was a different story. The company increased its community count in the state but absorption fell 23% year-over-year. This decline produced a 13% drop in orders for the quarter. MTH still managed to increase ASPs by 5%. Houston suffered the largest sales decline. The pressure on business in Texas has been long-anticipated, so I am sure this news did not surprise anyone.

Be careful out there!

Full disclosure: no positions