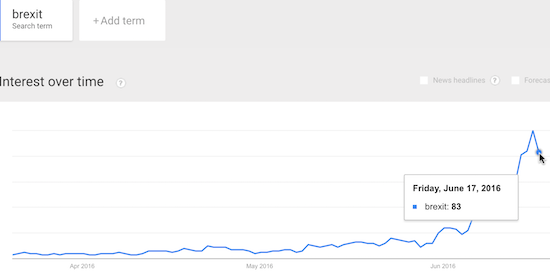

At the time of writing, currency markets opened trading this week with Brexit fear continuing to recede in the form of a big gap in favor of the British pound (FXB). Google Trends shows that on Friday, search interest in Brexit took a big step back (down 17%). This move confirms the apparent change in sentiment toward Brexit (a reduction in fear).

Source: Google Trends

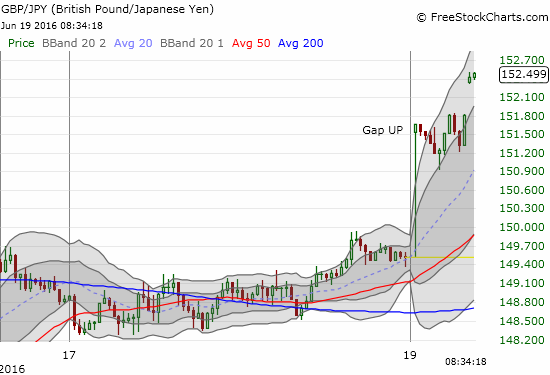

With momentum swinging, I am ending the strategy of fading rallies in the British pound (FXB) ahead of the UK’s June 23rd referendum on membership in the European Union (EU). However, I am also not chasing the pound upward as I think event risk remains to the downside going into Brexit. The trading opportunity for pound bulls is to see how far the momentum can carry you with a tight stop somewhere in the gap. If I execute any new trades, they will occur IF sellers manage to push the British pound back into today’s gaps. A combination of daily and 15-minute charts show the swing in direction that began last week.

Source: FreeStockCharts.com

Speculators started the apparent change in sentiment, but the data are only now available per the Commitments of Traders (CoT) from the Commodity Futures Trading Commission (CFTC). Data as of last Tuesday show a rush out of net short positions against the British pound. I do not think it is an accident that the British pound made a dramatic turnaround last week – too bad these data are not publicly available sooner!

Source: Oanda’s CFTC’s Commitments of Traders

Be careful out there!

Full disclosure: long and short the British pound in various currency pairs