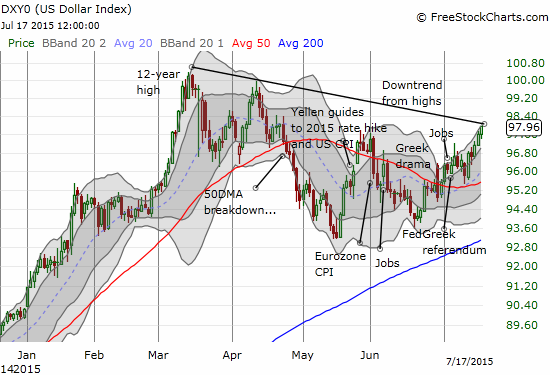

On Friday, July 17, 2015, the U.S. dollar index (UUP) closed just below the short-term downtrend in place since it made a multi-year high in March.

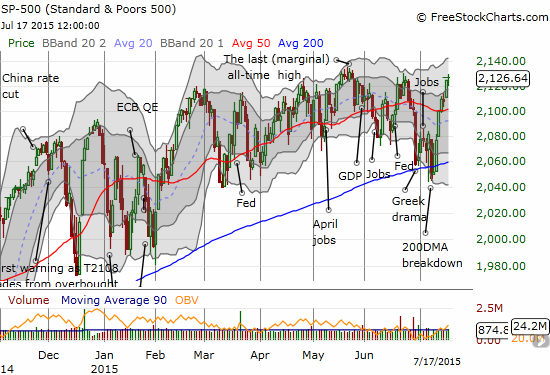

And for those who fear a strong dollar is bad for the U.S. economy, or at least the stock market, the S&P 500 (SPY) is apparently out to prove you wrong. Last week completed an impressive bounce from oversold conditions as the latest cycle of fear came to a resounding conclusion.

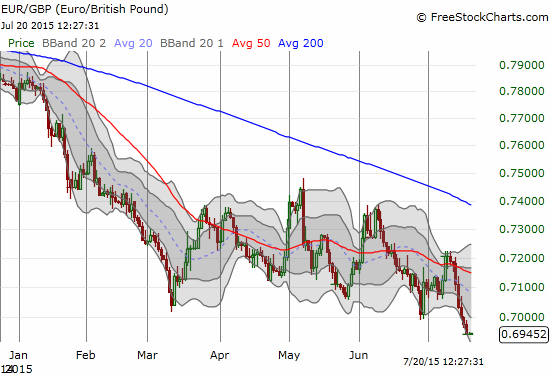

$EURGBP finally looks ready to break the 0.70 barrier. #forex

— Dr. Duru (@DrDuru) July 15, 2015

On July 16th, the British (FXB) pound finally made a clean break through the 0.70 mark versus the euro – a floor that had held as approximate support since March. EUR/GBP is now trading where it was back in late 2007.

Source of charts: FreeStockCharts.com

The U.S. dollar and the British pound have emerged as top currencies in a world where the dividing line between strong and weak economies, tightening and loosening monetary policy is perhaps more stark than ever in this post financial crisis period.

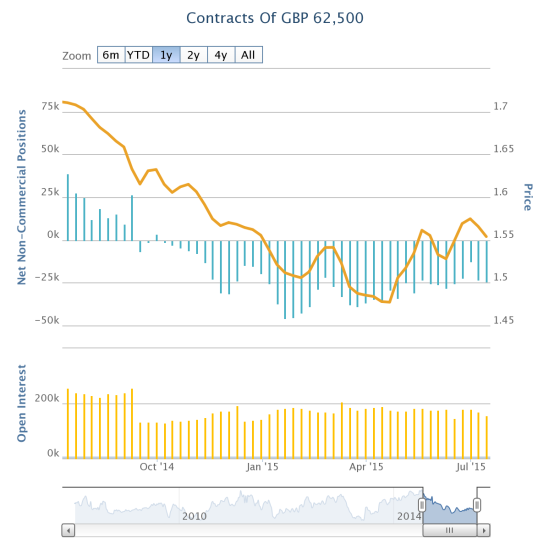

The only outstanding question now is whether the U.S. dollar or the British pound will benefit most from policy divergence. At around 1.56, GBP/USD is WELL off its high of just last year around 1.72 – advantage U.S. dollar for now. Speculators are still firmly betting against the British pound, likely using the U.S. dollar. This positioning makes me MORE interested in the British pound against other currencies because presumably, more upside exists in terms of the economic surprises that could catalyze relative differentials in performance.

Source: Oanda’s CFTC’s Commitments of Traders

Be careful out there!

Full disclosure: long and short various currencies against the U.S. dollar, long the British pound