On September 9, 2014, McDonald’s (MCD) produced yet another awful monthly sales report:

“McDonald’s Corporation today announced that global comparable sales decreased 3.7% in August. Performance by segment was as follows: U.S. down 2.8%; Europe down 0.7%; Asia/Pacific, Middle East and Africa (APMEA) down 14.5%.”

In the U.S. the problem is sluggish industry growth paired with intense competition. In Europe it is poor performance in Russia (surprise, surprise) and weak consumer sentiment. In Asia, MCD is dealing with major supplier issues in China. The Wall Street Journal blames millennials, but I am skeptical of this explanation. The bad news completely overshadowed an announcement later in the day that McDonald’s will accept Apple Pay throughout the U.S. Or perhaps this news helped propel MCD to an apparent bottoming the following day?

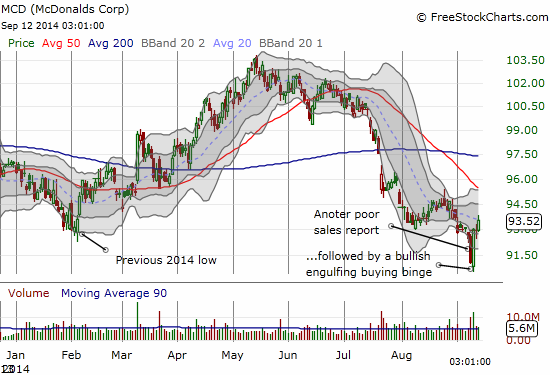

MCD closed on September 9th at a fresh 21-month low with a loss on the day of 1.5%. The next day, MCD gapped marginally lower, traded marginally downward from there, and then the buyers took over. On volume of 12.0M shares – more than double the daily average for the past three months and much higher than the 9.7M shares traded on September 9th , MCD closed the day with a GAIN of 2.1%. This 2-day whiplash created what is known as a bullish engulfing pattern: a common bottoming pattern as buyers finally swoop in to pick up shares on the “cheap”, the weakest hands are finally washed out, sellers are exhausted, and bulls and “value” players begin to reverse negative sentiment. In other words, this is a contrarian trade here…

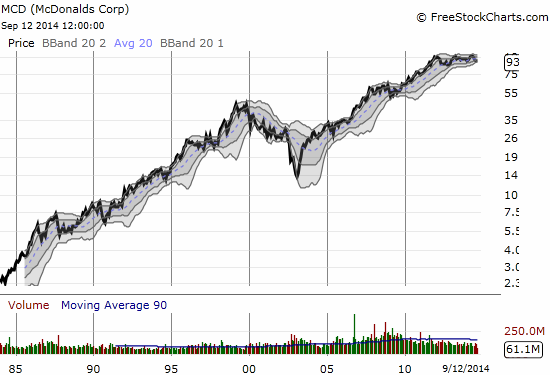

It is not easy to find such an emphatic bottoming pattern. So when I find one, I get excited. I am as bullish as I can get on this one by beginning a phase of aggressive accumulation of a position in MCD. I am starting with long-term call options since I do not expect a quick and easy road back to all-time highs. After all, MCD is NOT a momentum stock despite a decades long rise (see chart below). With a 3.4% yield, I am very interested in buying shares as well but will wait out the bottoming pattern a little longer: stiff resistance is looming overhead with a declining 50-day moving average (DMA). Traders have a very clear stop sitting right below the intraday low for the year. If sellers manage to push MCD that low again, the bullish engulfing pattern is invalidated. I rate those odds to be very low. MCD seems like a great risk/reward buy here.

Source for charts: FreeStockCharts.com