(This is an excerpt from an article I originally published on Seeking Alpha on March 6, 2013. Click here to read the entire piece.)

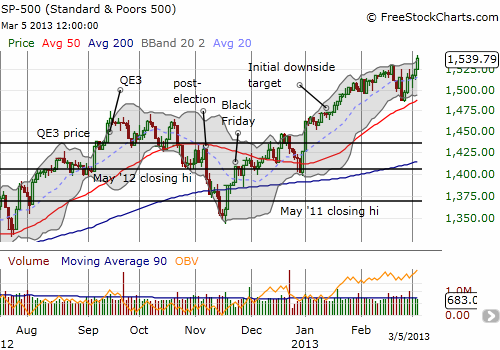

One hundred and two (102) calendar days and counting and the S&P 500 (SPY) still has yet to reverse all the gains from last year’s Black Friday rally.

{snip}

These 102 calendar days (almost 15 weeks) without a reversal of Black Friday’s gain are also historic. This is now the 4th longest post-Black Friday period since 1950 without a reversal. {snip}

The chart above includes a downside target I estimated after noting the continued weakness in the Australian dollar (FXA) as a potential drag on stocks. {snip}

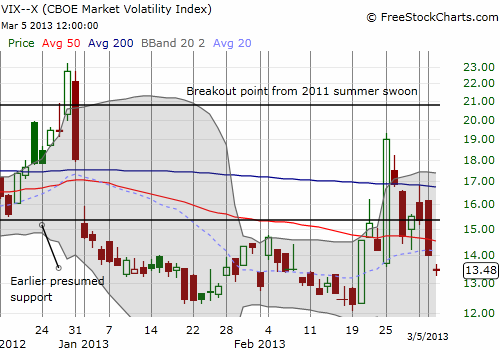

One of the most fascinating developments in recent weeks was the sudden outburst from the volatility index, the VIX. Two weeks ago, I wrote “Global Markets Synchronize Into A State Of Calm That Does Not Equate To Safety” as the VIX dropped to seven year lows. {snip}

Source for charts: FreeStockCharts.com

If the VIX remains at these low levels, churning up and down no doubt, it will likely support continued buying as the new-high celebrations roll onward with a renewed sense that such strong performance demonstrates “safety” has returned to the stock market. {snip}

Finally, this year has started with strong fund flows into stocks, further supporting a bull run. {snip}

Source: Fidelity

Net-net, the bullish path seems like it is still clear for what I have called the Black Friday Trade. Once this rally passes the 115-day mark, it faces a long road to third place: a 808-day streak from 1971 to 1974. In other words, given the rally has lasted this long, there is plenty of reason to believe that it can last much longer.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on March 6, 2013. Click here to read the entire piece.)

Full disclosure: long VXX shares and puts, SSO puts