(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are posted on twitter using the #120trade hashtag)

T2108 Status: 20.0% (Day #3 of oversold period)

VIX Status: 24.7

General (Short-term) Trading Call: Cover more shorts (keep a hedge) and finish building bullish trading positions (click here for a trading summary posted on twitter)

Reference Charts (click for view of last 6 months from Stockcharts.com):

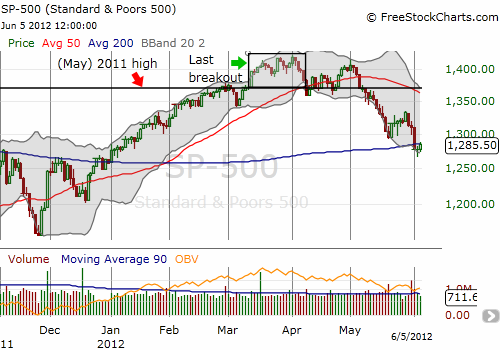

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar)

Commentary

Real quick update for today. T2108 is in its third day of the the current oversold period as the indicator trudged right to the 20% threshold. The S&P 500 also closed the day on the edge, right at the 200DMA.

The VIX dropped below its 200DMA. So, the ingredients remain active for a decent oversold rally. I added to my SSO calls on Tuesday and also bought VXX calls as a small hedge. The bounce off the 200DMA could be sharp as shorts rush to cover, disappointed at the lack of follow-through on Friday’s nasty close below the 200DMA. However, if/once the S&P 500 breaks Monday’s low at 1267, the index will likely confirm for us that yet another sell-off summer is at hand. In other words, this is essentially make or break time for a relief rally.

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long SDS, long SSO calls, long VXX calls