Evergreen Solar (ESLR) is a “penny stock” again. As the stock plunges to 8-year lows and toward all-time lows, it appears that the company will not survive this round of doubts in its viability.

Note well that in the past, I have not had good things to say about ESLR:

“ESLR remains the solar stock I love to hate. It is back at the $1.80 level of its secondary offering of stock in late May. I still do not think ESLR is worth any more than $1.80, and it is probably worth a lot less.” ( October 2, 2009)

Three weeks later, I was five months early in stating “I will not be surprised if ESLR breaks its March lows and trades under a dollar by year-end.”

My main issue with ESLR remains that quarter after quarter the company fails to deliver the financial performance that should match all its talk about the huge potential of its unique string ribbon technology for making solar panels. ESLR is a product company that struggles like a promising research and development company. In 2008, there were several splashy announcements about large multi-year contracts that only served to delay the eventual downdraft in the stock:

- ESLR finally built a significant new contract backlog with this announcement on May 22, 2008: “Evergreen Solar Signs New Sales Contracts of Approximately $1 Billion” – the new contract backlog equaled exactly $1B after this.

- June 18, 2008: Evergreen Solar Signs Two New Sales Contracts Totaling Approximately $600 Million – the contract backlog went to $1.7B.

- Evergreen Solar Signs New Sales Contract with IBC SOLAR of $1.2 Billion

– this increased ESLR’s contract backlog to a whopping $3B.

ESLR has not announced any more big contract wins since 2008. Instead, it has spent a lot of time dealing with tightening credit conditions and executing financing deals to keep the company running until that day sometime in the future when it is supposed to become a truly viable company. In one of its many financial transactions, ESLR loaned 30.9 million shares to Lehman Brothers as part of a $375M financing deal shortly before the company went bankrupt. I believe the lawsuit to retrieve those shares remains unresolved.

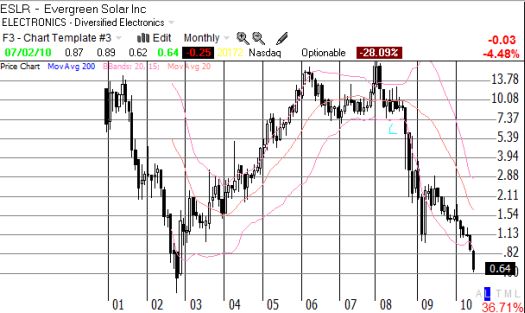

ESLR’s slide began in earnest in September, 2008 as the rest of the financial world came apart in the wake of Lehman’s bankruptcy. Unlike many companies that were performing OK up until that point, ESLR never got even close to its former price levels. The monthly chart below shows the rapid reversal of over five years of recovery from the 2002 all-time lows:

*Chart created using TeleChart:

Evergreen Solar was also the subject of ridicule from Senate Republicans during the “Full Committee and Subcommittee on Green Jobs and the New Economy Joint Hearing: Solar Energy Technology and Clean Energy Jobs” held on January 28, 2010. During these hearings, Missouri Republican Senator Kit Bond lambasted ESLR for all the subsidies it has taken from the U.S. government while providing few new jobs in the U.S. Senator Bond noted that ESLR has moved manufacturing facilities to China and will focus its future expansion there. He posted a chart showing that $44M in subsidies have generated only 700 American jobs (he did not note that this represents a doubling over the last three years). Note that this was part of a larger presentation attempting to demonstrate that solar energy will not provide the blue-collar and middle-class jobs that America needs. Proponents of solar tried to make the opposite case during this hearing but did not come prepared with equally dramatic numbers.

During the company’s earnings conference call the very next month, ESLR referenced its hiring freeze in the U.S. while at the same time ramping up hiring of engineers in China. Note this comes almost a year after promising to HIRE 90-100 additional workers at its Massachusetts Devens manufacturing facility as part of the Federal government’s stimulus spending to boost the economy in the state.

ESLR defended its record on providing jobs in the U.S.:

“We’re assuming that to sell in the United States you’re going to have to make something in the United States. It doesn’t mean bringing some laminates in, slapping on the frame and say Made In the U.S.A. It’s got to be more than that…Let us keep in mind that the United States facility…is still the centerpiece of our organization.”

Executives talked about what it had to do to compete with Chinese solar panel manufacturers that are being propped up by the Chinese government (emphasis mine):

“…if the Chinese are going to continue to sell near marginal costs because they get the support of the Chinese government, that’s just the way the world is…all we can hope for is this: that the US government will not let the Chinese replace the Middle East for access to solar energy…Short of that, all we can do is this, make our operations as streamline[d] as they can be, getting our costs as low as they can be, getting to China as fast as we can, and just execute and focus on what we can focus on.”

ESLR executives went on to lament that American politicians do not seem to “get it” – including Energy Secretary Chu, Commerce Secretary Gary Locke and various state and local politicians.

The last two earnings conference calls have highlighted ESLR’s struggle to survive (all quotes from Seeking Alpha transcripts, Q4 2009 and Q1 2010).

ESLR indicated during its Q4 2009 earnings conference call on February 4, 2010 that it would seek additional financing even as its access to the capital markets was limited. ESLR admitted that it does not have a strong capital line of credit. At the time, cash was a paltry $90M, and ESLR expected to burn through 2/3 of it within the first 6 months of 2010. Executives acknowledged that the cash burn was too high, but they were focused on growth (in China), not cost-cutting. They emphasized that investment in R&D has been a company mantra as far back as 2003 when Rick Feldt became CEO.

However, in response to an analyst question, ESLR did openly speculate on retrenching into a wafer-only company:

“As our wafers become more industry standard, the opportunity to do that [wafering strategy] is greater. Plus in our move to China if you appreciate the fact that we’ll have very, very low wafer costs and we get good Chinese manufacturers to convert those wafers into cells and panels we will be getting China conversion costs with a very low cost wafer. We have a brand. Yes it cold evolve over time where we focus more and more on wafers only, license the technology and make wafers only.

Once more, as we reduce those costs and we get China conversion costs for selling panels its not clear that we should just abandon our brand and abandon the tolling opportunity that we have in converting our wafers into panels.”

Credit conditions remain extremely tight for companies like ESLR:

“The one thing we really are trying to do and this may be hope against hope is that the US banking community will start going back to historic ways of supporting companies. By the end of the year we’re talking, we said earlier we could be at about 50 megawatts of sales at the end of the year. We’d have receivables of about $82 to $83 million, have inventory of $30 million. We can’t get a penny lent against that, this is absurd.”

Sure enough, ESLR announced on April 20 the pricing of a convertible stock offering valued at $165 Million. The deal closed 6 days later. Unfortunately, ESLR also revealed in its next conference call that this deal left its assets so leveraged that ESLR no longer qualifies for loans from MassDevelopment. Perhaps this is just as well. The Boston Globe noted in October, 2009 that the state of Massachusetts has already invested heavily in ESLR:

“Even before he won office, Governor Deval Patrick was counting on Evergreen Solar Inc. to energize the state’s economy…Once in office, Patrick sealed the deal by offering Evergreen more than $76 million in grants, land, loans, tax incentives, and other aid. It was one of the largest investments the state has ever made in the success of a private company…

…Evergreen’s struggles are particularly sensitive for the Patrick administration, because the governor made such a personal push for the firm…

…Evergreen’s incentive package from the state included nearly $21 million in direct grants to the company, $22.6 million in tax incentives, $13 million in grants to build roads, upgrade electrical transmission lines, and upgrade other infrastructure to support the 450,000-square-foot Devens plant, a $1-per-year lease for 23 acres at Devens worth $2.3 million, and $17.5 million in loans.

The company ultimately decided to forfeit the $17.5 million in loans, because it worried the terms of the debt could interfere with its efforts to borrow an even larger amount of money from outside lenders. But after its efforts to borrow elsewhere failed, the company recently asked MassDevelopment for a new $5 million loan.”

The $5M loan exceeded MassDevelopment’s $2.5M maximum but was approved in a unanimous vote at a board meeting. Moreover, MassDevelopment had already warned that ESLR “…does not currently generate enough cash to pay [the loan] back, and gave it the highest score possible for risk, 6 out of 6.”

Right before announcing the convertible, ESLR cheerily announced “selected preliminary first quarter 2010 results” and indicated that revenues were a relatively healthy $78.5M. Chairman, CEO and President Richard M. Feldt announced:

“Operationally, our Devens facility is performing very well, and as a result, we expect production and sales to increase to between 37 to 38 megawatts for the second quarter of 2010. Overall, demand for our product in the first quarter was strong and our selling prices decreased modestly by approximately 4% from the fourth quarter of 2009, mostly due to the stronger US dollar. Furthermore, our ongoing dialog with customers indicates that overall demand for our products in 2010 is expected to be consistent with the initial forecast of 175 megawatts we provided in February.

Our progress in Wuhan, China is on schedule and we expect to begin production in mid 2010. I am particularly pleased to report that we produced our first wafers from Quad furnaces initially being used for training purposes, which were installed in Wuhan in mid-March.”

The stock responded with a 6% gain to close at $1.25 the following day on extremely high volume. Nearly all this gain was wiped out after the announcement of the convertible. It was also a hard day for solar stocks across the board in sympathy with poor guidance from Canadian Solar (CSIQ).

The Q1 2010 conference call on May 5 reminded the financial community of ESLR’s continued struggles. ESLR announced that it used proceeds from the last convertible to pay off a convertible due in 2013. The company gained another two years of financing and netted $75M overall. Not much, but enough to keep the company on life support.

The company noted that it is trapped in its exposure to the euro, and its foreign exchange losses continue. Last quarter, it lost $2.2M in forex exposure. ESLR cannot hedge its exposure because it needs its precious little cash for funding capacity expansion. The company is not in a position to get an economical method for hedging.

ESLR looks cheap with a price-to-sales ratio of 0.47 and an even lower price-to-book ratio of 0.37, but it is a value trap. Overall operating cash flow remains negative at -13M and leveraged free cash flow is -$76M. ESLR noted that it is cash flow positive AFTER stripping out overhead on its one revenue-generating factory.

Nimble financing is keeping ESLR alive for now, but at maximum leverage, the company could very well collapse if all its development and operational plans do not roll-out perfectly over the next year or two. The risks in ESLR have never been higher and the penny stock status reflects that. (The company has even struggled with its neighbors over claims of noise pollution.)

When asked by the Boston Globe about the company’s chance of survival last October, CFO Michael El-Hillow responded that “…many predicted the company’s demise three years ago. ‘The company has defied the odds before…We’re still here.’’’

I find it more revealing and instructive that the CEO’s almost $500K bonus in 2009 was largely unattached to any financial targets or goals (see “Struggling Evergreen rewards CEO” for more details).

Be careful out there!

Full disclosure: no positions