The first half of 2010 has ended and another earnings season is upon us. The second quarter should be a time of easy comparisons as the economy hit a trough leading into spring of last year. If there is any credence to the argument that the economy is on a sustainable path to recovery, we should expect bullish forecasts and impressive year-over-year comparisons. Acuity Brands (AYI) had the misfortune of missing on both counts. The Atlanta-based manufacturer of lighting equipment reported earnings that motivated investors and traders to send the stock lower over 11%. Year-over-year results were very lackluster:

“…fiscal 2010 third quarter net sales of $407.6 million, a 3 percent increase compared with the year-ago period. Fiscal 2010 third quarter income from continuing operations was $21.3 million compared with $22.3 million for the prior-year period. Diluted earnings per share (EPS) from continuing operations for the third quarter of fiscal 2010 were $0.48 compared with $0.52 for the prior year.”

AYI was a small-cap company until last week when S&P announced index rebalancing that placed AYI into the S&P MidCap 400. Despite its size, I am always interested in hearing commentary and forecasts from the company on the commercial real-estate market. AYI has been very consistent quarter after quarter after quarter communicating the poor prospects in the construction of commercial and office buildings. The only difference this quarter is that the market seemed to finally care about the poor forecast (and the resulting soft earnings results) (emphasis mine):

“The increase in volume occurred in key products, such as lighting control devices and energy-efficient luminaires, and in key channels, such as renovation and relight and home improvement, all of which helped to offset declines in other sectors of the non-residential construction market, particularly commercial and office buildings, which were each down more than 30 percent compared with the year-ago period based on independent third-party data…We achieved unit volume growth while certain key markets, such as commercial and office construction, continue to be negatively impacted by lower economic activity and tight lending standards for real estate.”

“We expect the economic environment for the remainder of our fiscal year 2010 to remain challenging. Key indicators continue to signal declines for non-residential construction activity for the balance of 2010 and into 2011. Independent third-party forecasts continue to signal that for our fiscal 2010 the year-over-year percentage decline for net sales in the overall markets we serve will be in the mid-teens.”

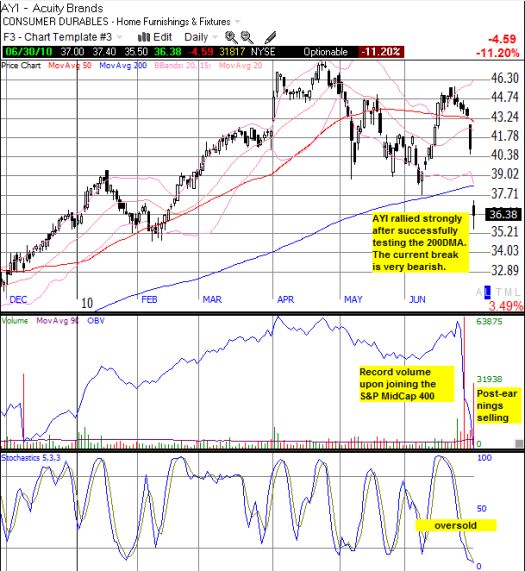

AYI was also characteristically optimistic about its ability to outperform its competition, cut costs, increase margins, and capitalize on unique opportunities. This time around, such encouraging words were not enough for a crowd that must be getting impatient waiting around for concrete signs of a sustainable turn-around. AYI’s stock broke down below its 200-day moving average (DMA) for the first time since last July. The stock is now oversold, but the high-volume breakdown sets a bearish tone that is likely to keep the stock under sustained pressure. After some kind of oversold bounce, I expect AYI to retest, and then break, the February lows.

*Chart created using TeleChart:

My wariness after last quarter’s post-earning surge proved warranted. The swing trade worked, but its end marked what now looks like a lasting high. In another case of luck working better than smarts, I just happened to fade AYI’s last surge with puts without even knowing about the pending earnings statement. I am still confounded by AYI’s sharp and strong performance after bouncing from the 200DMA, especially relative to the growing weakness in the larger market.

Be careful out there!

Full disclosure: no positions