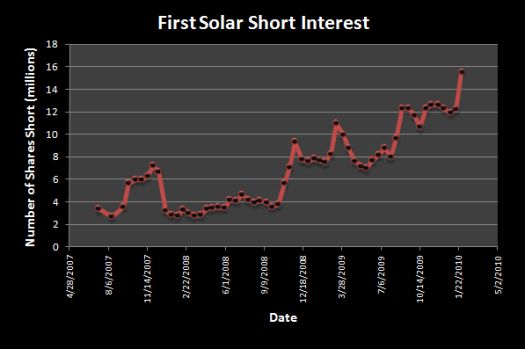

First Solar (FSLR) reports earnings tonight, and short interest is at a record high.

Data from nasdaq.com. Latest update January 29, 2010

This short interest represents about 36% of FSLR’s float.

Toss in negative news flow and for the first time in a long time, negativity is running extremely high going into FSLR’s earnings. As a result, I am positioned long going into earnings for the first time ever. This is a continuation of the “bottom-fishing” play I mentioned in FSLR a few weeks ago. I will not even be looking to fade any pop in the after-hours session.

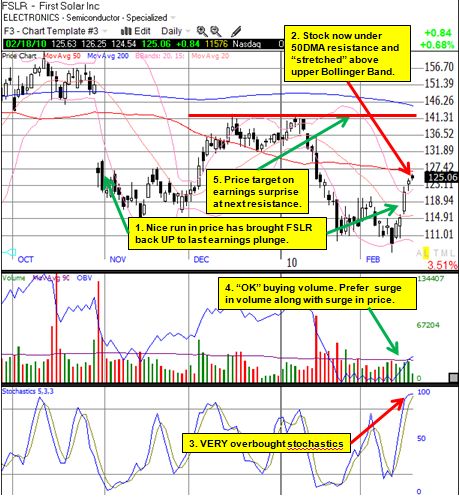

Unfortunately, the long overdue 13% price run-up into earnings has produced a poor short-term technical set-up. The stock is now overbought and right under resistance from the 50-day moving average (DMA). This is a classic set-up for a short, but I typically defer to news flow when it comes to earnings. Given the swell of negativity, if FSLR provides any positive surprises, the stock could immediately shoot to the next level of resistance around $143. If instead the stock sells off in response to earnings, I will be looking to add to holdings if the February lows hold (and selling current puts).

The chart below summarizes the short-term technical set-up (as of ~1pm today):

*Chart created using TeleChart:

Be careful out there!

Full disclosure: net long FSLR

4 thoughts on “Buying Into First Solar’s Record Short Interest Ahead of Earnings”