Google (GOOG) is now down 5% for the year, under-performing the NASDAQ which is essentially flat for 2010. The sudden surge in volume in GOOG suggests that a large group of traders and investors are selling on the news of the Nexus One release. This volume represents the most active trading in GOOG since its October earnings release.

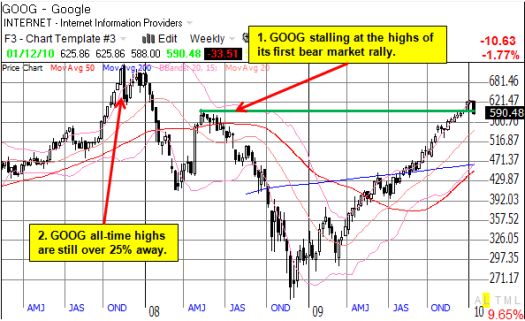

After GOOG hit $620 at the end of December, the post-earnings trade ended, and I closed the position. Now, I am betting that the 50DMA will hold as support ahead of the January 21st earnings announcement (sorry, no statistics on this play!). GOOG has not tested this line of support since July (see chart below). The test was “sloppy” then, and I expect the same here. The main saving grace with playing GOOG directly ahead of earnings is that there is little to no potential for an earnings warning to blindside the trade since GOOG does not release earnings guidance.

Regardless, unless GOOG drops a true stinker during its January earnings release, I expect to remain bullish on the stock for the foreseeable future. (Granted, the loss of China’s business could qualify as a major stinker even if it is not material for the January earnings discussion).

*All charts created using TeleChart:

Be careful out there!

Full disclosure: long GOOG

3 thoughts on “Trading Volume Finally Returns to Google – to the Downside”