(This is an excerpt from an article I originally published on Seeking Alpha on February 24, 2013. Click here to read the entire piece.)

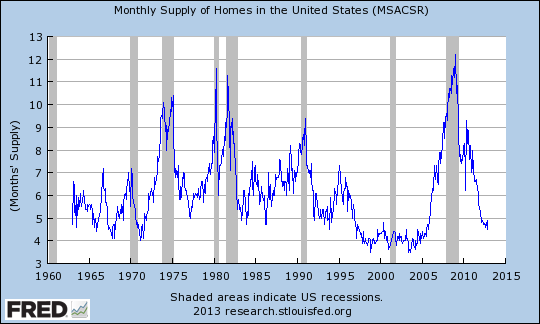

There were a lot of interesting nuggets in the January existing home sales report from the National Association of Realtors (NAR). The continuing decline in housing inventory has really caught my attention. NAR reports that inventories are pushing rock bottom levels {snip}

NAR describes a growing supply/demand imbalance that is particularly acute in select markets like the West where sales stalled because of limited inventories. {snip}

Source: St. Louis Federal Reserve

{snip}…if history provides an approximate model for the current recovery in housing, then we should expect the relative supply of homes to begin climbing within the next 2 years or so. The key ingredient, rising prices, has finally arrived.

{snip}…I now wonder whether inflation expectations are also acting to slow the return of sellers of existing homes.{snip}

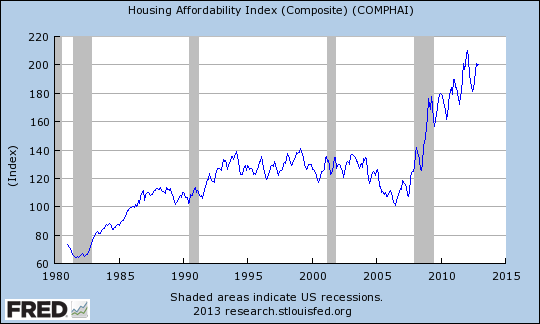

Rising prices also motivate buyers to get into the market to either avoid paying higher prices in the future and/or participate in asset appreciation. This dynamic is especially strong if buyers suspect interest rates are also on the rise which appears to be the case now. Here is what Toll Brothers (TOL) Co-Founder and Executive Chairman Robert I. Toll had to say during the company’s last earnings conference call…{snip}

The potential for pent-up demand can be seen in the St. Louis Fed’s Home Affordability Index…{snip}

Source: St. Louis Federal Reserve

With inventories and affordability at complimentary extremes, a significant supply/demand imbalance continues to build in the housing market in general. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on February 24, 2013. Click here to read the entire piece.)

Full disclosure: no positions