(This is an excerpt from an article I originally published on Seeking Alpha on July 17, 2012. Click here to read the entire piece.)

In “Tax Break Nears End For Online Shoppers“, the Wall Street Journal reports that the final dominoes appear to be falling in favor of providing states authority to tax online retailers. {snip}

In other words, a rare moment of bi-partisan agreement is aligning the winds of change to allow states to tax online transactions in the very near future. The WSJ describes the efforts in the meantime of Amazon.com (AMZN) to broker deals with individual states ahead of this seemingly inevitable legislation. AMZN is apparently rolling out a new strategy to enable same-day delivery by establishing more distribution warehouses. These warehouses establish a physical presence that enables the host state to justify taxation. {snip}

Clearly, the implementation of sales taxes makes AMZN less competitive on price and creates a more even playing field with physical stores. {snip} I think this sales tax avoidance will soon become small potatoes compared to what I believe is AMZN’s endgame: targeting the Wal-Mart (WMT) shopper.

{snip} As long as AMZN makes sure that its online competitors must pay sales tax, AMZN will wield an incredible competitive advantage in product delivery over them. Indeed, the WSJ claims that AMZN now supports a nationwide, comprehensive solution to taxation of online sales.

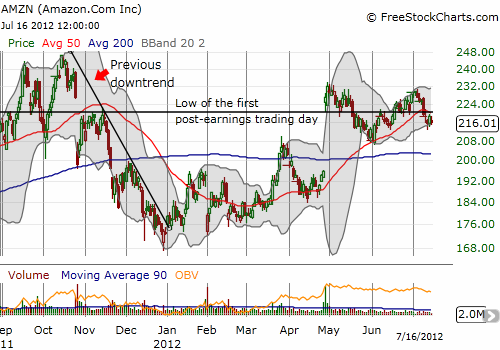

As the endgame approaches and sales taxes loom, AMZN’s stock has been stuck in neutral for a year. {snip}

Source: FreeStockCharts.com

{snip}

(This is an excerpt from an article I originally published on Seeking Alpha on July 17, 2012. Click here to read the entire piece.)

Be careful out there!

Full disclosure: long BBY, SDS