With a bear market underway and oversold trading conditions, I am actively looking for longer-term buys in the stock market. Tax, accounting, and personal finance services software company Intuit Inc (INTU) jumped into my radar thanks to CNBC’s Options Action. Michael Khouw laid out the case for buying a long-term INTU call option, but he seemed to cherry pick 1994’s 36x forward earnings to compare to today’s 29x forward earnings. I need a broader view, so I looked at multiple valuation metrics going back 10 years. These snapshots show Intuit has a valuation normalized by a bear market that has clobbered INTU 46% off its all-time high in November.

Valuation Normalized

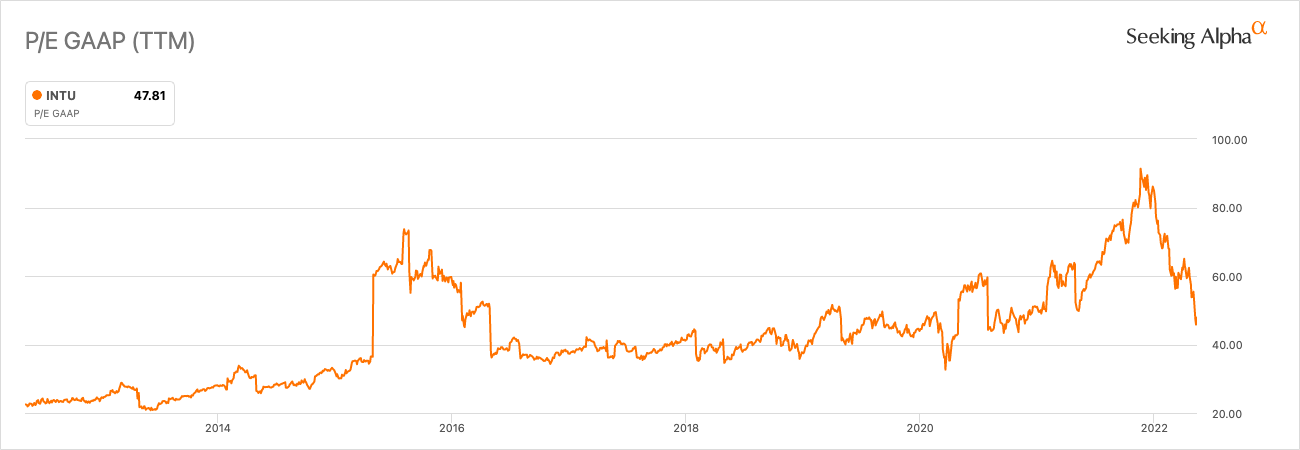

The sell-off in INTU has left valuation normalized back to multi-year lows.

The price/earnings ratio is at an 18-month low and back to the range that dominated trading from 2018 to 2020. Perhaps more importantly, the market finished wiping out Intuit’s entire pandemic era valuation premium.

Not only did the bear market erase Intuit’s pandemic era price-to-sales ratio premium, but also it pushed Intuit close to its P/S valuation low from the March, 2020 crash.

Perhaps most importantly, the price-to-cash-flow ratio for Intuit normalized back to pre-pandemic levels.

Each of these three valuation snapshots show how far out of whack valuations got even for long-standing, solid businesses like Intuit. The popping of this valuation bubble, what I am calling “valuation normalized”, places Intuit back to pre-pandemic levels. Note well that even in the months and years leading into the pandemic, one might rightfully question the general uptrend in valuation. A complete normalization could take INTU down another 25-35%, especially if business slows down from a recession.

The Trade

Khouw recommended buying a January 2023 $380 INTU call. While such a position makes sense as an alternative to buying 100 shares, the outlay still represents a large sum of money. I prefer to scale into a position buying shares and look to buy a call spread if/when the market delivers a climactic type of surge to the downside.

Be careful out there!

Full disclosure: no position