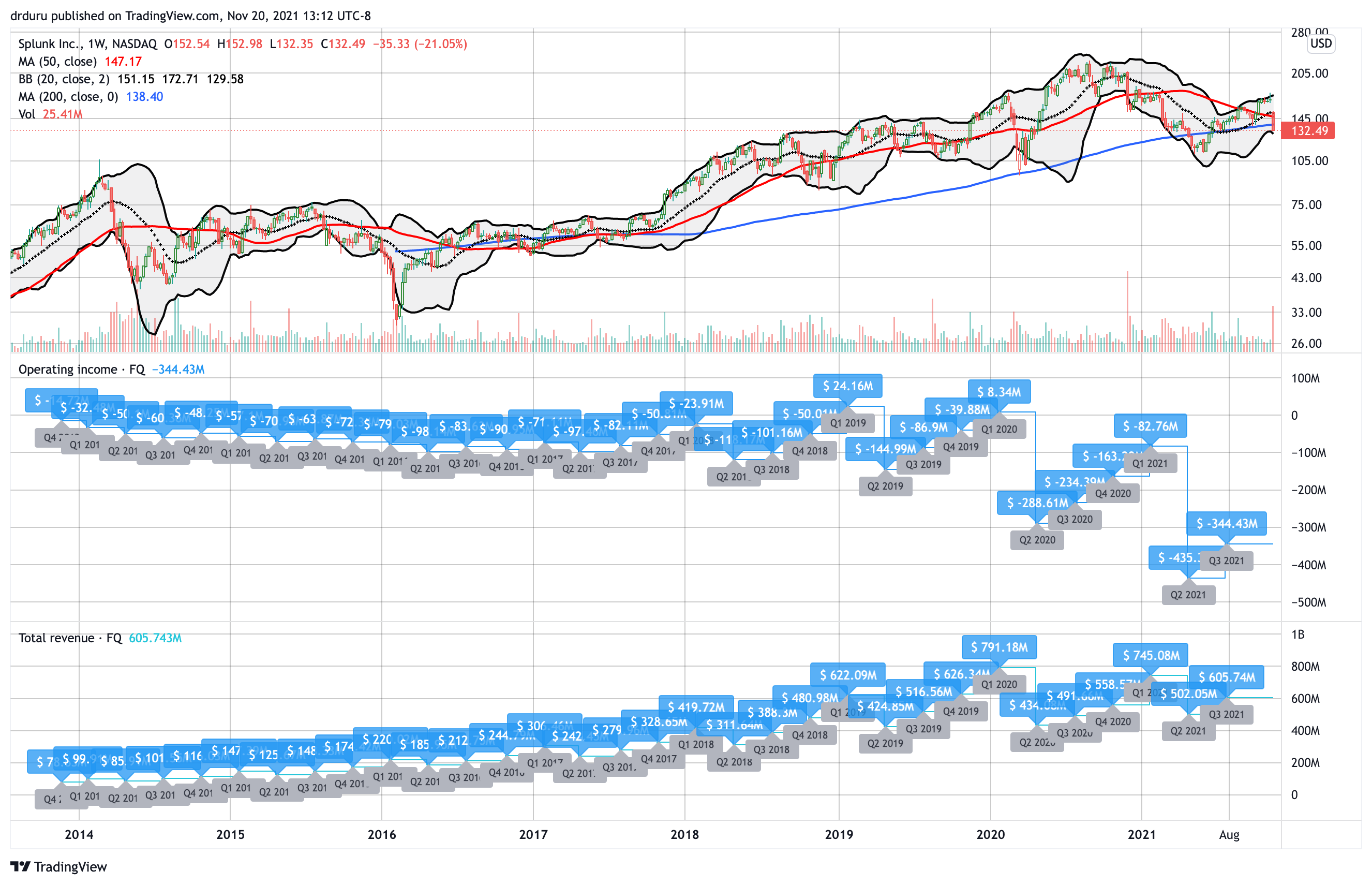

Splunk (SPLK) started last week with a gap down and 18.1% plunge in the wake of the resignation of CEO Doug Merritt. I thought the sell-off was an over-reaction given Graham Smith, the Chair of Splunk’s Board of Directors, stepped in to play interim CEO. However, the accompanying preliminary Q3 earnings report gave me pause. Splunk expects a -14% (non-GAAP) margin despite strong year-over-year revenue growth of 19%. I was surprised by the negative operational metric, so I looked at Splunk’s income history. Amazingly, after years and years of impressive revenue growth, Splunk has delivered negative income for all but two quarters (since at least late 2013). Suddenly, the market’s impatience makes sense.

In early October, I made the case for buying Splunk (SPLK). The stock broke out above its 50-day moving average (DMA) and seemed to confirm a post-earnings bottom. SPLK sprinted from there and managed to hit a 7-month high before piercing its way into a Bollinger Band (BB) squeeze. Unfortunately, that last bullish move turned into a fake-out. Sellers stepped in the next day and delivered a sudden 5.1% one-day loss. In retrospect, that reversal was a warning sign.

The long-term weekly chart suggests that the loss for the week could be a warning sign of a larger breakdown. SPLK peaked over a year ago in August, 2020. A 23.3% post-earnings plunge last December confirmed the transition from bullishness to short-term bearishness. The stock managed to re-establish the longer-term uptrend after bottoming in the summer. The momentum from that recovery is now over, and a new downtrend may be underway.

The main good news I see is SPLK’s low relative valuation. The current losses drove the stock price down to 9.4 times sales. This valuation is at the lower end of SPLK’s 5-year range. Accordingly, if SPLK retests the summer lows, I will consider bottom-fishing. In the meantime, SPLK is likely to suffer from the general selling pressure in the market from contracting market breadth.

Be careful out there!