Central banks are getting pretty good at having it both ways. Despite two rate hikes, one in July and one in September, the Bank of Canada (BoC) has talked its way to a net no change in the Canadian dollar (FXC) versus the U.S. dollar (DXY0).

Source: FreeStockCharts.com

As the chart above shows, the Canadian dollar has been on a definitive weakening trend against the U.S. dollar since the low of USD/CAD in early September. In particular, Deputy Director Timothy Lane helped to push USD/CAD off its bottom when he suggested that the Bank of Canada may be balking at the strengthening of the Canadian dollar. A week and a half later, the Canadian dollar broke out above its 50-day moving average (DMA) and confirmed the bottom. Today (October 25, 2017), the market responded bearishly yet again to what appears to be a very dovish statement on monetary policy. Yet, this fresh selling is a bit of a surprise given Lane gave a preview of the BoC’s return to dovish talk. From my post analyzing Lane’s commentary:

“…the Bank of Canada’s future monetary policy decisions may depend on the strength of the Canadian dollar (FXC). When the Bank of Canada cut rates in the wake of the collapse in oil prices, the Bank floated its hopes for driving stronger exports to ease Canada’s transition. While exports did not rebound as strongly as expected, the economy as a whole seemed to benefit. It makes sense that the Bank is now wary about how well the economy can or will absorb a stronger exchange rate. USD/CAD last traded at current levels in May, 2015.”

While I acknowledged the dovish implications of Lane’s comments, I still thought the market’s trigger finger response was overdone. Instead the move turned out the beginning of a new trend against the Canadian dollar. I thought the market would finish pricing in the change in BoC positioning by the time of the decision, but it seems the market still wanted to hear and see confirmation.

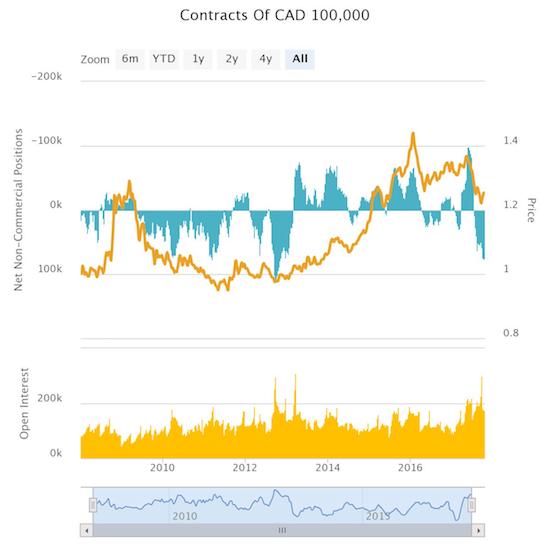

This bottoming may have caught speculators flat-footed; their inevitable exit may further exacerbate weakness in the Canadian dollar. Speculators are about as bullish as they were in 2012 in terms of net contracts, but open positions are significantly lower from the big spike on September 18th – a date which coincides with Lane’s speech.

Source: Oanda’s CFTC’s Commitments of Traders

Lane’s comments were brief and still subject to interpretation. In its statement on monetary policy, the Bank of Canada was definitively clear that rate hikes are completely off the table for the time being…even as Governor Stephen Poloz remained coy in the Q&A section of the press conference.

For example, in the press release on monetary policy, the BoC suggested that the Canadian dollar is stronger than anticipated in July (note well that USD/CAD has almost recovered all July’s losses now).

“The Bank projects inflation will rise to 2 per cent in the second half of 2018. This is a little later than anticipated in July because of the recent strength in the Canadian dollar.”

and..

“…projected export growth is slightly slower than before, in part because of a stronger Canadian dollar than assumed in July.”

The opening statement was as clear as a central bank can get on applying the brakes to rate hikes:

“Given our recent history with inflation running below target, we continue to be more preoccupied with the downside risks to inflation. The bottom line is that Governing Council will be cautious in considering future interest rate adjustments and will be guided by incoming data to assess the sensitivity of the economy to interest rates, the evolution of economic capacity, and the dynamics of both wage growth and inflation.”

Poloz gave four reasons for the BoC to “…be cautious in making future adjustments to our policy rate”: soft inflation, excess capacity in the economy, lagging wage growth, and excessive household debt levels.

When questioned directly about the link between the Canadian dollar’s strength and rate policy and the BoC’s apparent return to dovishness, Poloz and Wilkins resorted to coyness. One press member asked why the Canadian dollar features so prominently in the monetary policy report. Wilkins simply referenced the significant pass-through effect on inflation from currency moves by the second quarter of next year. She then deferred to the particular weakness of the U.S. dollar at the same time that the BoC hiked rates.

Another press member observed that the currency market was pricing away the possibility of a December rate hike based on the BoC’s positioning. She asked directly whether rate cuts are indeed off the table in December. Poloz responded that every meeting is a live meeting (of course!). Near the end of Q&A, a press member returned to this issue by asking whether rate hikes are off the table for the duration of the NAFTA negotiations. She even asked whether the BoC can afford to wait that long. Poloz of course did not provide a direct answer. In response to an earlier question on NAFTA, he noted that the BoC cannot incorporate projections around NAFTA given the underlying uncertainty and the potential for the economy to adjust just fine to any trade shocks.

In trading, I stopped out of a position short USD/CAD once the pair crossed above the GDP-driven peak last month. In the immediate wake of the market’s response to the BoC, I went long GBP/CAD for a quick flip. The weakness in the Canadian dollar is now quite extended, so I will not do any more chasing. Still, the path of least resistance for the Canadian dollar appears to be more weakness ahead. I am looking for USD/CAD next to test 200DMA resistance.

Be careful out there!

Full disclosure: no positions

Couldn’t stay in the long USD.CAD position after the second rate hike as I too was stopped out. Interesting that things get overdone the other way as well.

Interesting pricing for U.K. MPC decision. Pricing consistently above 70% for weeks and 80% plus now so it looks like they will hike, which is crazy. Glad I was not on the other end of that.

I wonder if there will be one more last spike for the USD or that is it for now. I am

looking for short USD plays and am drawn back to NZD. The election outcome was not surprising but I’ve been surprised by how large the market reaction has been. Canada no longer in play but NZ may be. Australia looks no longer in play for a while with recent tepid inflation number. Still large spec long position in AUD so short AUD.NZD is also tempting

I guess whether CAD will be able to break out of its range will depend on whether oil can break out. Oil is looking constructive currently but I wouldn’t be betting it breaks out.

The US dollar looks like it is gaining steam as the euro has topped and tapped out. I have some “leftover” shorts on the USD, but I am definitely not excited by them! I recently closed out a short USD/AUD though for a good penny.

Oil looks very stuck. I don’t think it will be strong catalyst for CAD for now.