(This is an excerpt from an article I originally published on Seeking Alpha on December 2, 2016. Click here to read the entire piece.)

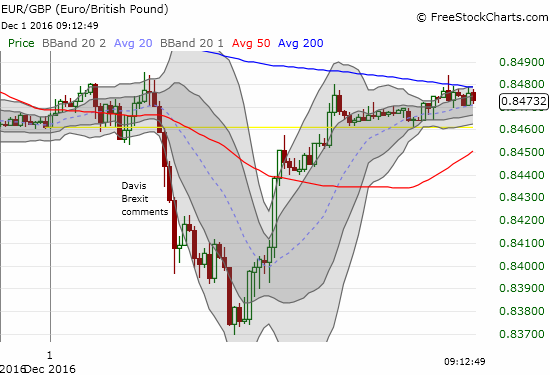

Before Thursday’s open for trading in the U.S. (December 1, 2016), the British pound (FXB) experienced another one of those “quick trigger” moves in reaction to Brexit-related headlines. I use “quick trigger” to describe a response that is so strong and rapid that it is likely bigger than the importance and/or conclusiveness of the news. In this case, it was commentary in a governmental session that motivated the market. According to the Daily Telegraph, Brexit Secretary David Davis declared that “…Britain would consider making payments to the EU budget in return for access to EU markets.” This comment came in response to a question from Labor MP Wayne David about the government’s willingness to make any kind of contribution to maintain access to the European single market.

{snip}

{snip}

Source: FreeStockCharts.com

{snip}

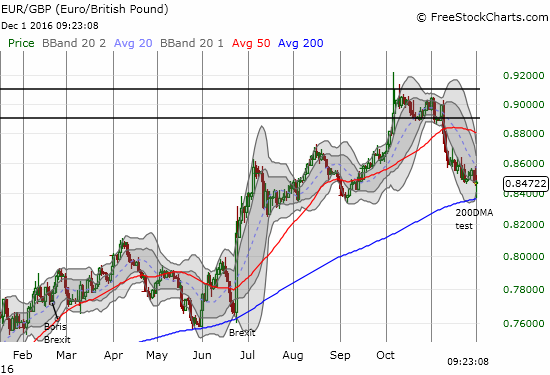

This episode reinforces to me that one of the market’s biggest anxieties about the British pound is the prospect of economic damage from reduced trading with the European Union (EU). The rapid reversal suggests that the source of (short-term?) buyers may finally be drying up. Accordingly, I have further increased my hedge against my long positions on the British pound to reach neutral, perhaps even slightly bearish. I will be watching the follow-through in EUR/GBP for clues on how to adjust the hedge in coming days (with some allowance for the coming election in Italy).

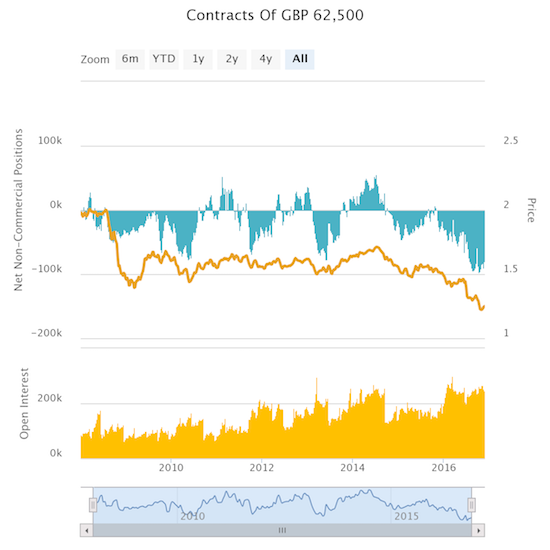

In the meantime, I have duly noted that speculators continue to retreat from net short positions very slowly. {snip}

Source: Oanda’s CFTC’s Commitments of Traders

Be careful out there!

Full disclosure: net long the British pound

(This is an excerpt from an article I originally published on Seeking Alpha on December 2, 2016. Click here to read the entire piece.)