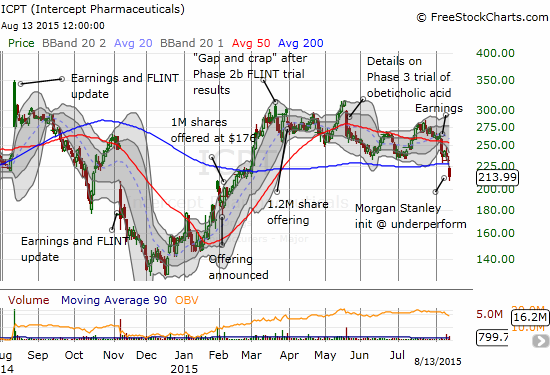

Morgan Stanley (MS) initiated coverage on Intercept Pharmaceuticals, Inc. (ICPT) with an underweight rating. The negativity weighed on the stock for a 7.9% loss that sent the stock below critical support at its 200-day moving average (DMA).

Source: FreeStockCharts.com

Morgan was VERY emphatic about its “out of consensus” call on ICPT. As reported by Investors.com:

“This is one of our highest-conviction, out-of-consensus calls…Near term, our concerns focus on the FDA review of Intercept’s lead candidate, obeticholic acid (OCA), for approval in Primary Biliary Cirrhosis (PBC), which is likely to increase scrutiny of the adverse lipid changes seen in the clinical trials…

In our survey, 44% of clinicians would limit OCA prescriptions to NASH patients with no cardiovascular disease/risk, or not prescribe the drug at all…The survey also found 50% of NASH patients have cardiovascular disease/risk factors. Compounding this, we think the NASH opportunity will take many years to evolve.”

As the chart above shows, the market reacted very negatively to ICPT when it released on May 19th details of its international Phase 3 trial of obeticholic acid (OCA) in patients with non-cirrhotic nonalcoholic steatohepatitis (NASH) with liver fibrosis. The trial will take 72 weeks to complete and involve 1,400 treated patients. Apparently, the scale and duration of the trial took the market by surprise. The trial will likely compel ICPT to raise more money and lean on the patience of investors. The stock has yet to recover from that knockdown and was in the middle of multiple tests of the 200DMA support ahead of Morgan’s takedown.

With a $5.2B market cap even after today’s sell-off, traders and investors should expect wild swings in ICPT on any news, positive or negative. The stock is likely already priced for the best outcome (or at least it was when it stalled out around $300 for four months this year), so negative news will weigh more.

From a technician’s viewpoint, ICPT continues to lose momentum slowly but surely. Doubts about the pot of gold at the end of the extended rainbow only serve to accelerate the downward pressure. Ever since ICPT gained notoriety with a massive one-day gap up in January, 2014, the stock has failed to generate further momentum. Almost every major news release since then has caused the stock to sell-off and/or top-out in the wake of the news. Until now, analyst consensus around positive narratives have helped to heal the stock between news releases. These are signs of what technicians call “distribution”: the market taking choice opportunities to unload shares when liquidity is high and/or when news runs contrary to the most optimistic assumptions that seem baked into the stock.

Be careful out there!

Full disclosure: long ICPT call options and short shares