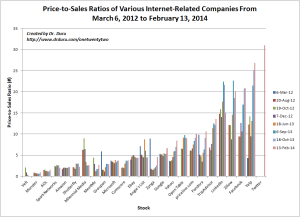

This is just a very quick update on the price/sales ratios of various internet-related stocks. Twitter (TWTR) hangs on to number one despite getting shellacked in its first earnings report as a public company (for my post-earnings trading analysis see “The Twitter Post-Earnings Trade Pivots On Increasingly Negative Sentiment“). The usual suspects round out the top spots.

Click on image for a larger view….

Source for valuations: Yahoo Finance

LinkedIn (LNKD) deserves special mention because it experienced a rare drop in valuation amongst the high-flyers. I have referenced the shorting opportunities in LNKD in several recent posts. I just assumed after the earnings disappointment the stock would rebound, and it did…for a day. The stock has sold off every single day since then, including a large sell-off on Wednesday, February 12th that I somehow completely missed. The stock is now around 7-month lows.

I am very tempted to try to play a bounce back to resistance at the 200-day moving average (DMA). Trading in LNKD has been extremely choppy, taking the stock on wild swings to and through points of support and resistance. The stock seems overdue for another classic sharp rebound, especially with the stock now stretched below the lower-Bollinger Band and resting at the bottom of the current downtrend channel. If I make a trade, I will tweet it with the hashtag #120trade.

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: long TWTR puts