(This is an excerpt from an article I originally published on Seeking Alpha on December 17, 2012. Click here to read the entire piece.)

Apple’s rollout of the iPhone5 in China hit a perfect storm on Friday, December 14th. Rumors were flying about lackluster interest and a reduction in orders to suppliers. Analysts released reduced forecasts and price targets. To top it all off, Fridays tend to be Apple’s worst trading day of the week.

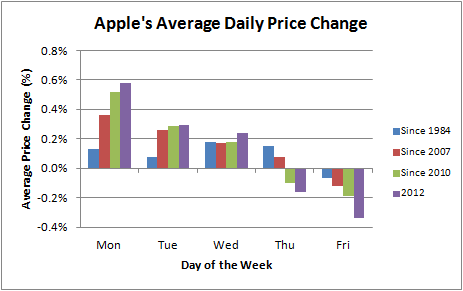

I covered Apple’s daily trading tendencies in August in “A Guide For Day-To-Day Trading In Apple’s Stock.” At that time, I found a relatively consistent pattern of Apple (AAPL) starting the week on a strong note but ending on a weak note. {snip}

Click for a larger view…

Source: FreeStockCharts.com

The rapid change in sentiment even shows up in the short interest piling up against Apple. {snip}

Source: NASDAQ.com short interest

However, negative sentiment is NOT yet showing up in the options trade which continues its heavy weight on call options. {snip}

While it seems “obvious” to trade with the current downward trend to the next level of support – especially with the current breakdown – counter-trend rallies like that in late November can happen at anytime for any reason. {snip}

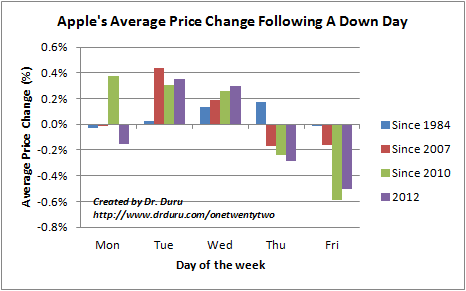

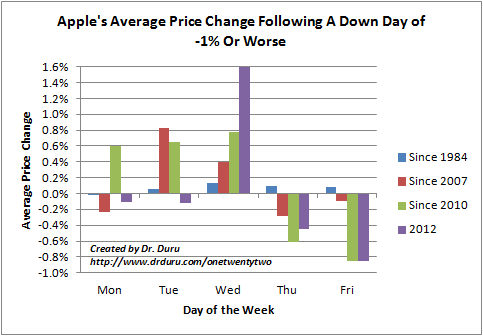

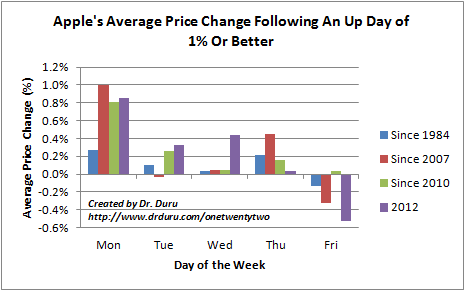

For reference, I have updated the daily trading guide below. {snip}

- Apple still tends to start the week trading strongly and to end the week trading weakly.

- The week tends to end even more weakly if preceded by weakness

- No differentiation in directional bias if the preceding day was an up day, although Wednesdays tend to be stronger and Fridays weaker if that up day is a performance of 1% or greater.

Source: Stock prices from Yahoo!Finance

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on December 17, 2012. Click here to read the entire piece.)

Full disclosure: long AAPL shares; long AAPL call and put spreads