It had to be too good to be true – Facebook (FB) CEO Mark Zuckerberg able to “motivate” his stock upward and out from the ashes of a post-IPO disaster. On Monday, September 25th, FB got hit by a bearish Barron’s article pegging Facebook’s value at $15/share. The stock subsequently crumbled under the pressure to the tune of a 9.1% loss and erased all of the momentum and most of the gains from the “Zuckerberg bounce” from his appearance at TechCrunch Dsirupt on September 11. Apparently, things might have gotten worse if circuit breakers had not kicked in to halt short-selling once the stock had lost 10% on the day. New short sales are banned until Wednesday (see “Facebook’s Slump Triggers Short-Sale Restriction“).

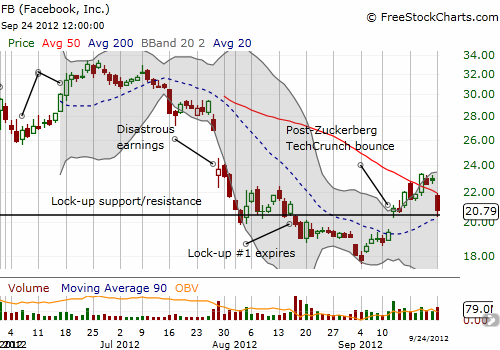

The technical set-up was ideal for shorts right from the open, and I automatically entered one myself. The stock not only broke its recent uptrend and momentum from all-time lows on September 4th, but it also started the day just below support from the 50-day moving average.

Source: FreeStockCharts.com

Note in the chart the horizontal line that marks the high of the day that insiders dumped millions of shares onto the market. That selling sent FB to new all-time lows at the time. The Zuckerberg bounce conveniently popped the stock just over this line. Monday’s sell-off conveniently ended right at this line. (You just can’t make this stuff up!). I think this behavior indicates traders should expect price levels around lock-up expirations to act as magnets/repellants.

FB now faces a critical technical test. The gap from the Zuckerberg bounce now seems sure to fill, and further selling should quickly send FB to fresh all-time lows. A revival to $24 should restart the positive momentum and position FB to fill the ugly gap down from its first earnings call as a company. I think the upside scenario is very unlikely in the near-term.

I closed out my short position once FB got over a 9% loss, not even realizing that the stock was heading toward a circuit breaker. I just did not believe the stock could lose 10% or more in a day. Closing out that position leaves me net long FB again…and leaves me wondering how/why I ever got into this drama. I have still not summoned the energy to write my mea culpa on FB as one of my worst stock trading/investing decisions of the year (my last defense of FB is here from June 10th: “Reuters Facebook Poll Fashioned to Feed the Fear“). Meanwhile, I am trading around the mess using great technical setups like today’s.

Be careful out there!

Full disclosure: long FB