(This is an excerpt from an article I originally published on Seeking Alpha on September 2, 2012. Click here to read the entire piece.)

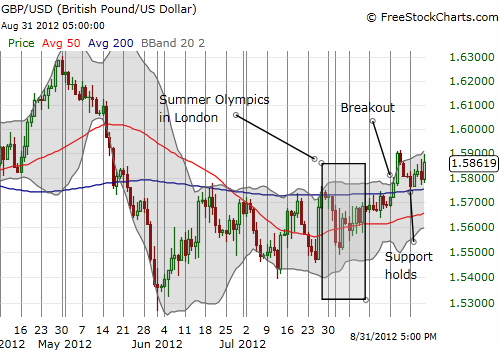

The currency markets have gone through waves and cycles of themes thanks to the constant tinkering and interventions by the world’s central banks. With the big news headlines for the United Kingdom receding in importance to the U.S. and Europe, it appears “safe”, on a relative basis, to ride the wave with the British pound. In “British Pound Breaks Out After Uneventful Summer Olympics In London,” I claimed that Jackson Hole would present a win-win for the British pound. While ECB President Mario Draghi had to bail on the Jackson Hole confab to attend to more pressing matters back home (like laying out plans to buy the bonds of bankrupt governments), Ben Bernanke seemed to deliver the catalyst the pound needed to bounce off important support.

The 200-day moving average (DMA) now looks like very firm support from which the pound should continue to rally against the U.S. dollar (FXB).

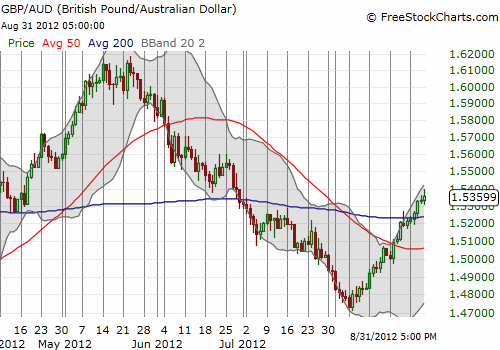

The presumed carry trade for the Australian dollar (FXA) and against the British pound continues to unwind…{snip}

{snip}

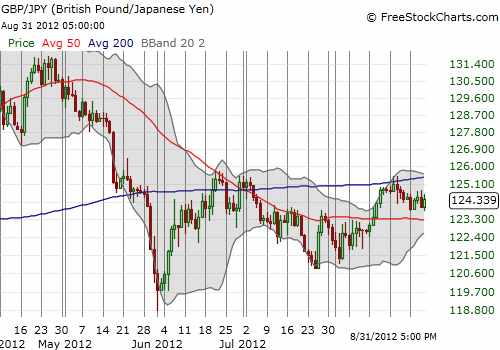

Finally, the ultimate test for the British pound is its match-up against the Japanese yen. {snip}

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 2, 2012. Click here to read the entire piece.)

Full disclosure: no positions (at the time of writing)