(This is an excerpt from an article I originally published on Seeking Alpha on August 13, 2012. Click here to read the entire piece.)

Since reporting earnings August, 1, First Solar (FSLR) has been on a tear. {snip} This trading action represents strong follow-through to the nascent bullish action I pointed out on June 19th:

{snip}

Source: FreeStockCharts.com

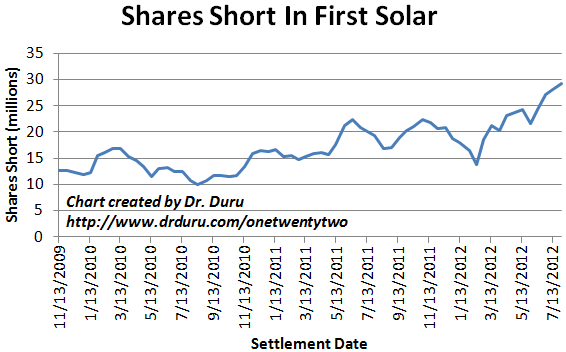

Shares short against First Solar reached an all-time high just ahead of earnings…{snip}…

Source: NASDAQ short interest

Despite the encouraging action in First Solar, I think it is still a trading stock for now. Accordingly, I used the rally to close out near-term call options and switched to near-term puts to hedge the remainder of my (base) position in FSLR. I next looked deeper into the earnings results to try to identify whether something sustained and lasting had changed in First Solar’s business….{snip}….

The chart above shows that FSLR has finally a stalled a bit over the last three days. If these levels do not mark the peak of the recent rally, I then expect a top around $24 where the initial surge after FSLR’s restructuring news ended. On the downside, I am looking for FSLR to eventually fill its post-earnings gap up but find some temporary support at the now upward trending 50DMA. At that time, I will evaluate whether it makes sense to flip the trade back to a (short-term) bullish bias. My assessment will depend on whether short interest has increased to even higher levels, and whether the general stock market still maintains a bullish bias.

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on August 13, 2012. Click here to read the entire piece.)

Full disclosure: long FSLR calls, long and short puts