(This is an excerpt from an article I originally published on Seeking Alpha on August 5, 2012. Click here to read the entire piece.)

On July 20th, I described the mechanics of making the pre-earnings trade on F5 Networks (FFIV) (see “Lessons From The F5 Networks Earnings Trade“). After finishing the post-earnings trade with a gain of 4.2%, FFIV imemdiately faded the next day… {snip}

Source: FreeStockCharts.com

{snip}

Source: earnings dates from briefing.com, stock prices from Yahoo!Finance

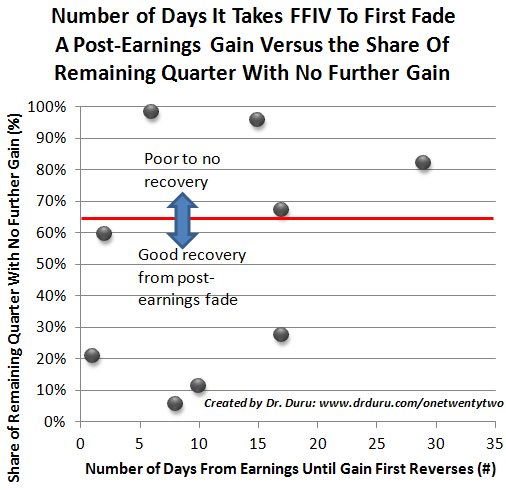

This chart suggests that there is a relatively good case for buying FFIV in the aftermath of earnings after the first day’s gains have been completely erased…especially for a short-term bounce. At current levels, the wind is behind this trade. {snip}

The company’s earnings and revenue guidance were slightly lower than expected because “the context of a weak global economy [led FFIV] to be more cautious in [its] near-term outlook.” While the economic climate is out of the company’s control, FFIV still has a strong position in key sectors of high-tech:

{snip}

For now, I have purchased call options in anticipation of an imminent bounce from current levels. I have hedged this with a small amount of shares short. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on August 5, 2012. Click here to read the entire piece.)

Full disclosure: long FFIV calls, short FFIV shares