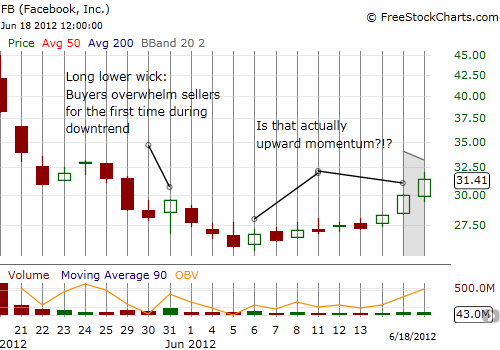

Nine days and counting. That is how many trading days have passed without Facebook (FB) marking fresh post-IPO lows. For twelve trading days, nothing but negativity swirled around the FB IPO. It was if the company itself were about to go bankrupt – taking all 900 million users with it.

On May 31st, I pointed out a potential reversal pattern in FB’s stock. That bottom failed to materialize, but the day that brought the pattern-breaking close is the current post-IPO low…so, I will call it “close enough.” Friday’s close above the high of the bottoming pattern finally confirms the pattern (again, I am taking some liberties given FB did print one more new closing low).

Source: FreeStockCharts.com

I earlier suggested that the cacophony of negativity surrounding FB’s post-IPO trading was creating an opportunity for big buyers. They could transfer stock out of the hands of folks who bought at the IPO price for a decent-sized discount (see “Reuters Facebook Poll Fashioned to Feed the Fear“). The current momentum certainly seems to confirm this process. FB is still a broken stock and has a LOT to prove going forward; resistance to further gains should get ever stronger as FB approaches its IPO price of $38. However, my bias tells me that a year or so from now feelings of seller’s regret will greatly replace the fear of FB. I will not be surprised if in that time the stock even experiences at least one blistering “fear of missing out” rally.

Be careful out there!

Full disclosure: long FB