The pound continues to flunk the test of a safe haven currency. Both the yen and the U.S. dollar have been soundly beating out the currency for the entire month of May – for example, CurrencyShares British Pound Sterling Trust (FXB). Those beatings have accelerated along with the worsening crisis in the eurozone.

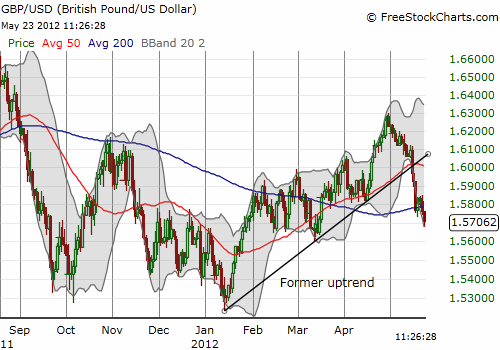

The chart below shows multiple breakdowns against the U.S. dollar (GBP/USD). The former uptrend broke just as the currency pair broke below the 50-day moving average (DMA). This week, GBP/USD broke decisively below the 200DMA.

Source: FreeStockCharts.com

The weakening of the pound looks less obvious because of all the focus on the crumbling euro. However, I think the message of the market is that the U.K. economy is going to continue to weaken along with Europe’s and that the Bank of England will soon be forced to implement yet more quantitative easing (QE). I will have more to say about the recent Inflation Report and its implications in another post. In the meantime, I continue to focus on short-term trades going short against the pound using the U.S. dollar and/or the Japanese yen.

Be careful out there!

Full disclosure: net short euro