(This is an excerpt from an article I originally published on Seeking Alpha on January 31, 2012. Click here to read the entire piece.)

The path for a peak in the Japanese yen is turning into a much more arduous one that I had hoped.

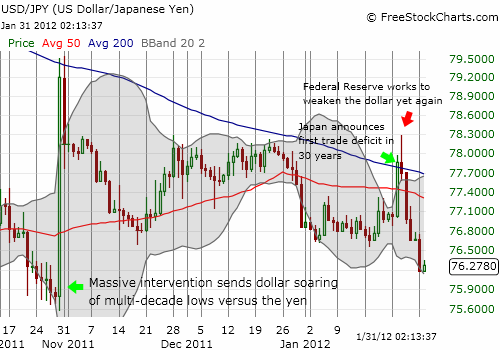

Last week, I pointed to an imminent acceleration in purchases of foreign assets and commodities and a change in trader positioning as potential signs that the yen is finally peaking. Seemingly on cue, the U.S. dollar surged against the yen – Rydex Currency Shares Japanese Yen Trust (FXY) – two days later after trade data showed, as expected, that Japan suffered its first annual trade deficit in 30 years.

The next day, the U.S. Federal Reserve extended its expectation for near-zero interest rates to 2014, and the U.S. dollar (UUP) has dropped against all major currencies ever since. In just five days, the sharp reversal has dropped the U.S. dollar to its lowest point against the yen since last November’s intervention. THAT intervention came as the U.S. dollar hit multi-decade lows against the yen.

{snip} If the yen does continue to strengthen, I will be looking to buy Australian dollars against the yen, not more U.S. dollars. See “Australian Dollar Hitting Critical Junctures” for more details.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on January 31, 2012. Click here to read the entire piece.)

Full disclosure: net short Japanese yen.