This is an excerpt from an article I originally published on Seeking Alpha on October 30, 2011. Click here to read the entire piece.)

{snip}

Today, I am going to try again to make the case that LPS is potentially turning around. Here are the main points and observations:

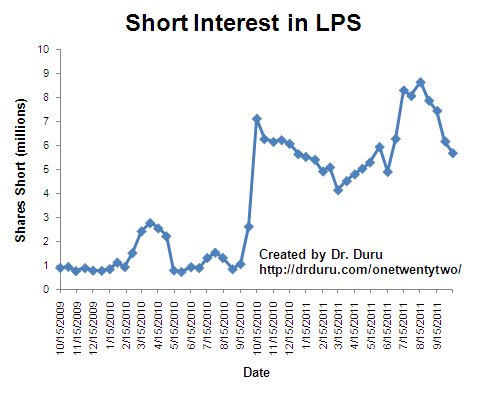

- Short interest is down 34% from the all-time on August 15, 2011.

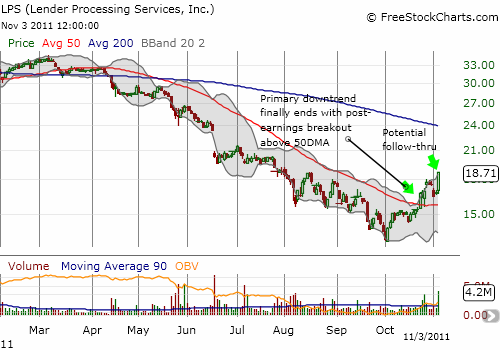

- The market responded well after LPS raised earnings guidance on October 25.

- That response sent LPS above its primary downtrend marked by the 50-day moving average (DMA) for the first time since March, 2011.

- On Thursday, November 3, the stock gained 11% on high buying volume in what looks like convincing follow-through to the break in trend.

- An energetic new CEO who is a 30-year veteran in the mortgage industry.

- Thomas Schilling, CFO and former interim CEO, has made spent $459,050 buying LPS shares from November 10, 2010 to August 8, 2011.

The graphs below show the history of short interest in LPS and its recent price history.

Source: NASDAQ

Source: FreeStockCharts.com

{snip}…new CEO Hugh Harris…{snip}…staked his claim to three top priorities for the next 90 days (all quotes and material from the Seeking Alpha transcript of the earnings call):

- Review and assess business operations and structure, making whatever adjustments in business focus and hiring/roles to improve performance.

- Focus on regulatory and legal issues.

- Tell LPS’s “positive story” (aka public relations)

LPS explained that the quarter’s revenue and earnings were better than expected…

{snip}

I have long stopped buying and selling puts on LPS and am now just sitting on my small amount of shares. {snip}

Be careful out there!

(Click here for an archive of my previous posts on Lender Processing Services).

This is an excerpt from an article I originally published on Seeking Alpha on October 30, 2011. Click here to read the entire piece.)

Full disclosure: long LPS